Doing business in EU without corporation tax in 2024

With this page we present to global entrepreneurs a legally simple way of doing business in Europe, while enjoying zero corporate taxation. Kindly read below for further details:

-

Corporate strategy

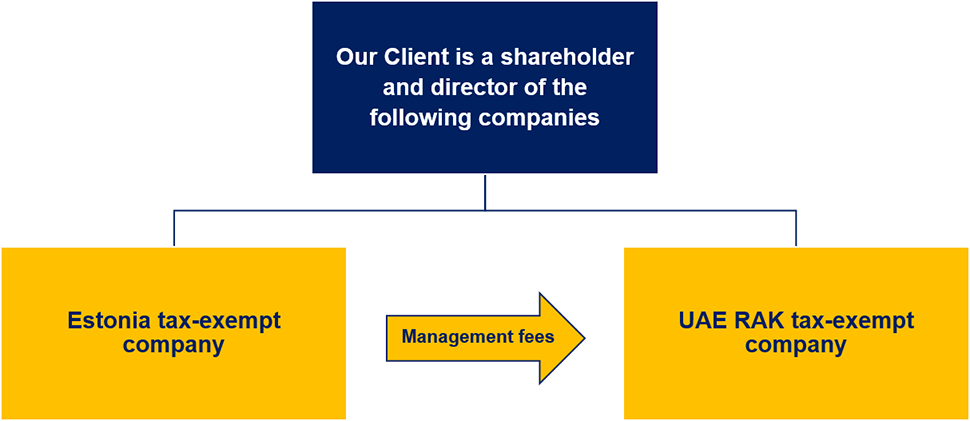

- Healy Consultants registers two companies for our Client; an Estonian LLC and a UAE offshore company (click link);

- In compliance with the Estonian Commercial Code, an Estonian company can conduct business locally and internationally without suffering Estonian corporation tax. Therefore, profits accumulate within the entity, legally tax exempt;

- In compliance with Estonian Income Tax Law, distribution of profits in the form of dividends suffers withholding tax of up to 10% (click link). To extract profits from the Estonian entity, foreign company management fees can be expensed against its net profits, and paid to a UAE company, without suffering Estonian withholding tax;

- In simple terms, a legally tax exempt UAE offshore company will invoice the Estonian LLC for management fees. The management fees are paid to the UAE corporate bank account without suffering withholding tax in Estonia. There are no taxes in the UAE. This is how an Estonian company can be legally tax exempt;

- For each Client business, Healy Consultants will secure written confirmation from Estonian lawyers and accountants confirming this corporate structure is legal in Estonia.

-

Advantages

- Through an Estonian LLC, our Client can legally conduct business within the European Union without suffering corporation tax;

- The Estonian LLC can register for EU VAT and is part of the single euro currency. VAT in is Estonia is 20%, the lowest in Europe;

- An Estonian LLC can be incorporated within 6 weeks, with one shareholder and one director of any nationality;

- To improve the ability to close sales and pay suppliers faster, the Estonian LLC can have multiple corporate bank accounts all over Europe;

- An Estonian LLC enjoys convenient access to EU and Russian markets;

- Estonia has signed double taxation avoidance agreements with 55 countries including i) Austria ii) Mexico iii) India and iv) Hong Kong;

- Use cost-efficient EU SEPA corporate bank account;

- Enjoy minimal administration requirements.

-

Disadvantages

The legally tax-exempt structure described above is highly dependent on the UAE-Estonia double taxation avoidance treaty. If the treaty is amended or interpreted differently by the Estonian tax authorities, the Estonian company could become subject to local corporate income tax. -

Healy Consultants fees

Clients should expect higher fees for this tax-free solution as i) the engagement involves registration of two companies, one in Estonia and one in Dubai and ii) our Client will need to appoint a nominee local business administrator in Estonia. Refer to draft invoice embedded in the link below:

EU tax-fee vehicle Average engagement costs €17,170 Draft invoice View invoice PDF All engagement fees (click link) are agreed and paid up front and agree to the fees published on our country web pages. Consequently, there are no hidden fees, surprises or ambushes throughout the engagement. All engagement deadlines are agreed up front in the form of a detailed project plan, mapping out deliverables by week throughout the engagement term.

Every week during the engagement, Healy Consultants will email our Client a detailed status update. Our Client is immediately informed of engagement problems together with solutions. Your dedicated engagement manager is reachable by phone, Skype, live chat and email and will communicate in your preferred language.

-

Legal, accounting and tax considerations

- The corporate income tax in Estonia is imposed at a standard rate of 20%, however if there is no business done within the country, there is zero corporate tax exposure;

- All companies must register with the Estonian Tax and Customs Board and file monthly tax returns by 10th of the month following the end of the taxable month;

- Royalties and technical service fees paid to a non-resident are subject to a 10% withholding tax, unless reduced by a tax treaty;

- Employers are required to pay all employee social security contributions of up to 33% of their staff employment remuneration;

- Estonia does not implement net wealth tax, which is applicable to other EU countries, including France, Spain and Netherlands;

- It is important our Clients’ are aware of their personal and corporate tax obligations in their country of residence and domicile; and they will fulfill those obligations annually. Let us know if you need Healy Consultants’ help to clarify your annual reporting obligations.

-

Corporate bank account solutions

- Top banks in Estonia are Scandinavian owned, including: i) Swedbank and ii) SEB bank;

- Healy Consultants recommends our non-EU Clients to open their Estonian corporate bank account with a bank with which they already have a bank account in another home country or alternatively aim for a more reputable and internationally recognized EU bank, such as: i) HSBC ii) Barclays iii) Commerzbank;

- Estonian banks offer services with increasing quality and convenient online banking in English. Furthermore, local banks prove to be less stringent in the due diligence pre-approval policy.

Opening a corporate bank account in Estonia

To secure timely corporate bank account opening on our Client’s behalf, Healy Consultants will proceed as follows:

- Our Client to choose the best corporate bank account amongst the different banking options proposed by Healy Consultants;

- Healy Consultants timely prepares and submits a complete corporate bank account opening application to the preferred bank;

- The bank may require our Client to notarize or legalize a set of corporate bank account due diligence;

- Once the corporate bank account is approved, Healy Consultants emails our Client the bank account details required for the share capital transfer.

-

13 steps to acquire a tax-exempt EU trading vehicle

- Prior to Estonia company registration our Client i) settles Healy Consultants’ engagement fees ii) signs our Client Engagement letter and iii) provides us the due diligence documents;

- Healy Consultants drafts a detailed Estonia business incorporation engagement project plan mapping out step by step incorporation engagement process and corporate bank account opening process in order to optimize transparency and to set the Client’s expectations towards the engagement completion;

- Healy Consultants Incorporation Team prepares and sends our Client a Memorandum and Articles of Association together with the shareholders and directors consent forms for the Client’s signature and subsequent courier return to Healy Consultants’ head office;

- Healy Consultants then conducts a company name search with the Estonia Central Commercial Registry so as to verify the uniqueness of the proposed company name;

- Healy Consultants assists our Client to open a corporate bank account in Estonia with an international top tier bank with excellent internet banking services, so as to provide our Client with the best corporate banking experience. Our Client then injects the paid-up capital (minimum of €2,500) to the company’s account;

- Healy Consultants registers the company for EU Value Added Tax (VAT) with the Estonian National Tax and Customs Board;

- As a next step, the exact Dubai corporate structure is agreed with our Client. Thereafter, Healy Consultants i) reserves company name with the Department of Economic Development and ii) prepares company deeds of establishment and articles of association notarized by a notary public in the Dubai courts;

- Healy Consultants will assist our Client open a Dubai corporate banking account with a local bank. Our Client deposits the paid up share capital and supplies Healy Consultants with a certificate of deposit and bank statement;

- Healy Consultants then i) pays the Chamber of Commerce fee ii) notarizes all company documents and iii) registers the company with the DNRD and Labor Department;

- The license application is submitted to the Dubai Economic Department together with i) the MOA ii) name approval certificate iii) the lease agreement iv) a certificate of paid up share capital. Within three weeks, business license approval is received;

- Subsequently, Healy Consultants assists our Client register the UAE LLC with the Company Registry Office and obtain a Company Registration Certificate from the Ministry of Commerce. Thereafter, the company MOA is published in the Ministry of Economy and Commerce‘s Bulletin;

- Following engagement completion, Healy Consultants couriers the two company kit folders to our Client’s preferred international address, containing the following corporate documents including original corporate documents, unopened bank correspondence and a Client feedback survey;

- Our Client activates e-banking and executes funds transfers between both corporate bank accounts, using management fees invoices. Healy Consultants will supply our Client a pro-forma template of such an invoice.

All

All