Hong Kong client case studies in 2024

-

Hong Kong company renewal service

Background

Our Client’s principle business activity is holding investments. The company was incorporated in December 2019 and in addition to our renewal services the Client had also engaged us for nominee shareholder and director services. Our Client engaged us to renew the company’s business license, to continue providing them with company secretary and legal registered office, and to complete their accounting and tax obligations with the Inland Revenue Department of Hong Kong.

Engagement overview

- In December 2020, Healy Consultants Group in-house Accounting and Tax Department emailed our Client the renewal invoice that included i) renewal of secretary and legal registered office ii) renewal of nominee director and shareholder services and iii) annual accounting and tax services.

- Following our Client’s understanding of the annual obligatory requirements, they proceeded to settle our renewal invoice by beginning of April 2021 to commence the process.

Engagement planning

- Healy Consultants Group’s received confirmation of the Client funds transfer from our Group Financial Controller.

- Healy Consultants Group’s Accounting and Tax Department (ATD) was then assigned to assist our Client to complete their Hong Kong company’s renewal, accounting and tax obligations.

- Thereafter, a detailed email including i) an overview of the project plan ii) key milestones of the renewal engagement and iii) important government deadlines are provided to the Client.

- Thereafter, the Client is requested to provide documents including i) Trial balance, ii) Bank statements, and iii) Supporting documents. These documents are required to draft a high-quality financial statement for our Clients.

Hong Kong company renewal

- The Company should deliver its annual return in Form NAR1 to the Companies Registry for registration within 42 days after the anniversary date.

- Within 3 weeks after receiving all documents from our Client, ATD team prepared the first draft of the financial statements for our Client’s Hong Kong company. The draft financial statements are sent to our Client for review and approval only after the same has been reviewed and approved by management for quality purpose.

- Once the draft is approved. ATD team of Healy Consultants Group proceed with the finalization of the financial statements. The finalized financial statements are review by management and Aidan for quality purpose before they are sent to the Client for signature.

- After securing the signed financial statements, ATD team prepares a renewal application to the Inland Revenue Department (IRD) within 2 weeks, including i) dormant financial statements and ii) license renewal application.

- Within 1 week thereafter, ATD team had successfully submitted an annual statutory obligation to the IRD including i) business registration ii) annual returns and iii) profit tax returns.

- Nonetheless, after a period of two months IRD also issued a notice in regards to employer’s return of remuneration and pension to the Client.

- After receiving the official notice from IRD we immediately informed our Client re the same.

- Once our Client confirm to engage Healy consultants Group for this additional service, ATD team then immediately proceeded with the submission of the same to Hong Kong IRD.

- Within 2 weeks thereafter, we had successfully completed the employer’s return of remuneration and pension obligation.

Engagement completion

- By the end of October 2021, Healy Consultants Group’s ATD team completed the engagement by successfully ensuring the Annual Obligations of our Client was completed in a timely manner.

- ATD team emailed our Client i) new business registration certificate, ii) annual return certificate, iii) financial statements, iv) profit tax returns, and v) the submitted employer’s return of remuneration and pension for record.

- ATD team requested our Client i) to provide a professional reference and/or ii) to complete Healy Consutlants Group PLC’s Client satisfaction questionnaire.

- Thereafter, ATD team wrote this case study and recorded a video to help our multinational Clients walk through the process of renewal in Hong Kong (click link).

-

A Hong Kong Company Accounting and Tax Obligations in 2021

Background

Our multi-national Client’s Hong Kong LLC was incorporated in Hong Kong in 2016. The principal activities of the company are engaged in food provision and logistic support services to the US government. The main Hong Kong LLC services include tailored solutions for a) food and water provision, b) hotel accommodation and c) general logistic support.

During 2021, Healy Consultants Group in-house Accounting and Tax Department was required to timely accurately and completely discharge our Client’s annual legal, accounting and tax obligations.

Accounting and Tax Obligations

- Once we received the retainer fee payment from our Client, we sent a detailed email including an overview of the project plan and requesting for the documents required to complete the accounting and tax obligations;

- After the Client supply us all the required documents such as trial balance, bank statements and sales invoices during the accounting period, Healy Consultants Group in-house Accounting and Tax Department prepared draft financial statements for our Client review and approval. Immediately thereafter, we submitted the same for independent statutory annual audit;

- In the meantime, Healy Consultants accounting team will complete the i) renewal of Business Registration Certificate and ii) annual return filing for the financial year end;

- Healy Consultants accounting team obtained Client’s approval and signature on the audited financial statements;

- Healy Consultants accounting team completed the Profit Tax Return filing once IRD Hong Kong issue the PTR form for the year of assessment.

Engagement Completion

- Once the above was completed, Healy Consultants accounting team sent a summary of obligation to the Client, attached with i) Signed audit report, ii) Annual return form and iii) Tax return form for their acknowledgment;

- Simultaneously, we asked our Client for an online professional reference.

-

Vessel crew management company establishes Hong Kong company

Background

Our Client engaged us in March 2021 to set up a non-resident company in Hong Kong, that will work as an offshore platform and vessel crew management company, as well as provide management activities.

Healy Consultants Group discussed the corporate structure of our Client’s corporate bank account needs for the new entity over a Skype call.

Our Client completed our engagement letter and provided 100% of KYC documents to our Compliance Department. Our Client also settled the first instalment to proceed with the engagement.

Engagement planning

Healy Consultants sent a detailed project plan to our Client, outlining all steps until engagement completion and included relevant timelines at each stage of incorporation and corporate bank account opening.

We also prepared and presented a draft business plan for our Client’s review and approval. The business plan is used to facilitate a smooth bank account opening process.

Hong Kong non-resident company registration

Healy Consultants performed a name search on the Hong Kong Company Registration portal. As the Client’s preferred company name was available, we secured confirmation.

Our Client couriered the original documents to Hong Kong as requested by the Registrar. Healy Consultants prepared a set of incorporation documents and submitted them to the government authority.

One week after submitting the documents, our Client’s new entity was incorporated in Hong Kong.

Healy Consultants’ Hong Office is the registered office for our Client’s new entity. We also agreed to be Company’s corporate secretary to meet the statutory requirements of the Hong Kong Companies Act.

Corporate bank account opening

Our Client finalised and signed the Business Plan that included business activities, UBO and bank signatory information, as well as projected revenue streams and the company’s desired banking requirements.

Our Client wanted a Singapore corporate bank account as this jurisdiction is viewed as recognised and stable. After the entity was incorporated, Healy Consultants approached multiple Singapore banks, including DBS, OCBC and CitiBank.

Unfortunately, Singapore banks did not provide any confirmation of interest, and therefore Healy Consultants submitted formal applications to global banks in different jurisdictions, including in Europe, America and Asia.

Eventually, an account was secured and opened with a Puerto Rico bank within one month of KYC documents being submitted to the bank. Shortly after, our Client activated e-banking and was able to start performing international fund transfer payments.

Engagement completion

After company incorporation and corporate bank account opening were completed without our Client’s travel, Healy Consultants mailed the company kit to our Client.

During the engagement, we provided a detailed engagement update every week to our Client, reflecting each stage of the engagement and highlighting the tasks to be performed, challenges encountered and suggested solutions.

-

Vessel space consultancy firm sets up Hong Kong operation

Background

- Our Client approached us in late 2019 to set up a company in Hong Kong to provide operational consultancy advice & trading vessel space specific to commodities;

- After discussing all options with our team, our Client decided to incorporate an offshore company in Hong Kong, and open a corporate bank account in Singapore;

- The Client chose a Hong Kong company because it is tax-efficient, and an ideal domicile for a business with international clientele;

- The Client chose a Singapore corporate bank account because he is based in Singapore, and wanted a high quality account with good online banking;

- In December 2019, our Client settled Healy Consultants Group’s engagement fees for the above structure.

Engagement planning

- Our team provided a detailed proposal, outlining the breakdown of costs and the engagement time frame. All fees were agreed upfront, so there would be no hidden charges or surprises, for our Client;

- Healy Consultants Group assisted with the registration of the new Hong Kong entity, pre-filling incorporation forms for our Client’s signature;

- Our team then assisted our Client to submit documents to the Hong Kong Companies Registry;

- Following Hong Kong company registration, Healy Consultants received, on behalf of our Client, legal corporate documents including i) Certificate of Incorporation ii) Memorandum and Articles of Association and iii) Business registration certificate;

- Healy Consultants Group supplied weekly detailed engagement status updates to our Client throughout the company incorporation process.

Singapore corporate bank account opening

- Before starting the process to open the Singapore corporate bank account, our Client i) settled Healy Consultants Group’s outstanding engagement fees and ii) provided additional supporting documents required;

- Our Client was given several Singapore options to consider. These included most leading regional banks and international banks. Our Client opted for the regional bank;

- Healy Consultants Group arranged a meeting with the bank in Singapore. Our team attended the face-to-face know your client (KYC) meeting with the Bank officer, alongside our Client;

- The meeting went well and two weeks after the meeting, Healy Consultants Group secured bank approval for the Singapore bank account;

- We followed up with the bank, and our Client, to confirm the latter had received the Internet banking login / device / password and activated the account;

Engagement completion

- In April 2020, Healy Consultants Group completed the engagement, having successfully i) registered the Hong Kong entity, ii) opened the Singapore corporate bank account for our Client and iii) couriered the company kit containing all corporate documents to our Client.

-

Management consultant sets up company with HK bank account

Background

- Our Client engaged Healy Consultants Group to register a Hong Kong company to provide management consulting services. After understanding the Client’s goals, business activity and intended corporate structure, Healy Consultants Group felt confident that we could open a Hong Kong corporate bank account for our Client.

Engagement Planning

- Healy Consultants Group confirmed that the Hong Kong company can be registered within one week of receiving all required KYC documents;

- Our Firm also arranged a certified copy of our Client’s passport from a Hong Kong Certified Public Accountant (CPA);

- Our team then submitted a company incorporation package to the Hong Kong Companies Registry;

- In addition, our Client confirmed that he required Healy Consultants Group’s assistance to open a Hong Kong corporate bank account;

- Our Client was required to travel to Hong Kong for a face-to-face interview with a local bank officer, as part of the bank’s increased due diligence/KYC checks.

Corporate bank account opening

- Within six weeks of the face-to-face meeting with the Hong Kong bank, our Client’s corporate bank account was successfully opened;

- Within one week of the account being opened, Healy Consultants Group couriered the internet banking token and activation correspondence to our Client’s preferred address.

Challenges and Solutions

- Hong Kong banks are increasingly selective about onboarding customers, partly due to high demand for their banking services. As a result, regulations have become more stringent and the due diligence process more time consuming. In this case, as with all other cases, Healy Consultants Group aggressively negotiated and followed up with the Hong Kong bank officers, ensuring the entire due diligence process was completed in a timely manner, and that the corporate bank account was opened within the timeframe we had indicated to the Client.

Conclusion

- Within two months of the start of the engagement, Healy Consultants Group had successfully completed Hong Kong company incorporation and Hong Kong corporate bank account opening for our Client’s business;

- We wish our Client all the best with his business endeavours!

-

Central Asian fashion retailer sets up global holding company

Background

- Our Client is one of the largest and most successful fashion retailers in the Caucasus and Central Asia, with its headquarters in Azerbaijan;

- Our Client required an investment holding vehicle to finance new retail business projects in strategic markets, thereby contributing to the expansion of its parent Group of companies;

- Our Client planned to expand the footprint of the luxury brand portfolio by targeting Central Asian and East European countries;

- After an initial phone call and Skype discussion, our Client and Healy Consultants Group agreed that Hong Kong company setup would be the optimal solution;

- Our Client completed and signed Healy Consultants Group’s engagement letter and provided to us scanned copies of the complete due diligence documents. Our Client also settled the first fee instalment to begin the engagement;

Engagement planning

- After detailed discussion with our Client and a thorough study of their business profile, Healy Consultants Group drafted a detailed Engagement Project Plan, outlining i) the various engagement steps ii) estimated timelines to incorporate a legally tax-exempt Hong entity and iii) estimated timelines to secure a corporate bank account in Hong Kong;

- Our team drafted a quality Business Plan explaining i) the company’s business activities ii) expected turnover and banking transactions, and iii) management background of the company;

- Thereafter, we completed Business Plan draft and the Engagement Project Plan and sent both to the Client for approval.

Corporate bank account opening

- One week after receiving payment and required documents, Healy Consultants Group supplied our Client with the company numbers for his newly-established Hong Kong company;

- Thereafter, our Corporate Banking team prepared a comprehensive business plan and approached multiple Hong Kong banks to determine their interest in onboarding our Client’s company. For four weeks our corporate banking team aggressively negotiated with multiple banks, and arranged meetings with multiple Hong Kong banks;

- Healy Consultants Group closely liaised with the bank to assist our Client to prepare a corporate bank account opening package including i) corporate documents ii) quality corporate bank account opening application forms and iii) KYC documents for our Client.

Meetings with Hong Kong bank officers

- Our Client travelled to Hong Kong to meet multiple bank officers for two days. Healy Consultants Group’s in-house Hong Kong banking experts met our Client in the city and accompanied them to the bank meetings. During the business trip, our Client submitted multiple corporate bank account opening applications;

- Within six weeks of submission of the quality corporate bank account opening documents, Healy Consultants Group secured a multi-currency corporate bank account with an international bank Hong Kong;

- Multi-currency corporate bank account details and e-banking tokens were directly couriered to our Client’s preferred address.

Conclusion

- Healy Consultants Group successfully completed the Hong Kong offshore company setup with a corporate bank account in an international bank within three months;

- We emailed the Client i) a complete Client file ii) unopened bank correspondence and iii) a Client feedback survey.

-

Hong Kong company completes annual accounting and tax obligations

Background

- Tich Giang International Ltd. was incorporated in Hong Kong in 2016. Nguyen Tien Trung, the Director of Tich Giang International Ltd, is a professional airline services consultant. He has been working in the industry since 2002 in Vietnam as an independent contractor. He plays the role of middleman between airlines and aviation service providers such as recruiting agencies. He offers consultancy services to these aviation service providers on how they can improve on and satisfy requirements from airlines;

- Mr Trung approached Healy Consultants in 2016, when he outlined his business strategy. This was to locate the business in Hong Kong to capture a significant share of the growing demand for aviation consulting services.

Engagement Planning

- Healy Consultants Group e-mailed our Client an Engagement Enhancement Proposal, including a detailed invoice. Thereafter, we prepared a detailed Engagement Project Plan, which outlined a step-by-step roadmap to complete the engagement.

Accounting and Tax Obligations 2018

- Mr Trung required Healy Consultants’ assistance to complete his company’s accounting and tax obligations for the 2018 financial year;

- Having received payment from the Client, our team sent him an e-mail including an overview of the project plan, and requesting the documentation required to complete his company’s accounting and tax obligations. After the Client supplied all the required documents, Healy Consultants Group accounting team began the audit;

- Our accounting team drafted an audit report, and reverted to the Client to address any queries or ask for more information;

- Healy Consultants sent the draft audited financial statement to the Client for signature and approval, and this was duly received by return;

- Healy Consultants accounting team filed the Profit Tax Return for Year of Assessment (YA) 2019 to the Hong Kong Companies Registry.

Engagement Completion

- Upon completion of all the above, Healy Consultants’ accounting and tax team sent a Summary of Obligations to the Client with i) Signed audit report ii) Annual return form and iii) tax return form. The Client acknowledged receipt of the same.

-

A Hong Kong Company Accounting and Tax Obligations 2018

Background

- Global PR Limited was incorporated in Hong Kong in 2017. Ahmet Tunc, Director of Global PR Ltd., has over 10 years’ experience working as financial consultants for business Clients in Europe. He also holds senior management roles in several companies in Germany, and possesses significant expertise in various sectors including consulting, real estate, finance and trading. Consequently, he also has an extensive network of trusted partners around the world.

- Having found Healy Consultants, he approached Healy Consultants in 2017. In an e-mail with Healy Consultants, Mr. Ahmet outlined his business strategy, which is to locate in Hong Kong to capture a significant share of the growing demand for consulting service.

Engagement Planning

Upon Client’s approval, Healy Consultants Group emailed our Client a formal invoice for the agreed services. Thereafter, Healy Consultants Group sent a detailed engagement project plan to notify Client the timeline and procedures to complete the engagement.

Accounting and Tax Obligations 2018

- Once we received payment from the Clients, we sent a detailed email including an overview of the project plan and requesting the documents required to complete the accounting and tax obligations. After the Client supply us all the required documents such as bank statements and sales invoices during the accounting period, the Healy Consultants Group accounting team began the accounting and tax process.

- Healy Consultants accounting team drafted an audit report and revert to Client with audit queries (if any). Healy Consultants obtained Client’s approval and signature on the draft audited financial statement.

- Healy Consultants accounting team filed the Profit Tax Return for YA2019.

Engagement Completion

Once the above was completed, the Healy Consultants accounting team sent a summary of obligation to the Client attached with i) Signed audit report, ii) Annual return form and iii) Tax return form for their acknowledgment.

-

Completion of accounting and tax obligation for a Hong Kong software start-up

Background

- Our Client, based in Bangladesh, had desired to start-up a new business in Hong Kong to offer various quality software applications including Apple App Store and Google Play Store, targeting various Client bases around the globe;

- Hong Kong was chosen as the location to start-up their business because it remains one of the few remaining destinations for expansion of the company.

Engagement planning

- Healy Consultants Group prepared and emailed Client an engagement advancement proposal and invoice for the agreed services;

- Healy Consultants Group emailed Client, request for due diligence documents and sign engagement letter;

- Thereafter, Healy Consultants Group prepared and emailed Client a detailed engagement project plan mapping out a step by step plan to engagement completion as well as a quality business plan.

Accounting and Tax Obligation

- Once we received confirmation of fund transfer received from Healy Consultants’ Group Financial Controller Ms. Sharon and assigned an ATD team member to provide accounting and tax services;

- We then sent a detailed email requesting some document such as bank statement, trial balance and invoices during the accounting period from our client in order to prepare management account for auditor if the company was active;

- An audit was required, as the company was active during the financial period. Thus, we engaged with the auditor by request for fee quote once Client provide trial balance;

- The audit began with some audit queries requesting some documents, invoices, agreement and clarification;

- The auditor provides draft audited financial statement and tax computation for client’s approval and issued signing pages soon after client agreed with the draft audit report;

- Thereafter, finalize audited financial statement was issued and we filed profit tax return for our client’s company to Hong Kong Inland Revenue Department.

Engagement completion

- After completed on above, we send a summary of obligation to client indicated that we have completed accounting and tax obligation for client’s company for their acknowledgement.

-

Hong Kong offshore company with Singapore corporate account opening

Background

- In 2019, our Client approached Healy Consultants Group to setup a Hong Kong offshore company and open a Singapore corporate bank account for this newly incorporated entity. The business scope of the Hong Kong company will offer mediation services to companies that have business conflicts to provide solutions and to settle payments. They will give their clients the option of legal advice through their network of lawyers and quote a certain fee for this and a percentage of the resulting settlement fee.

Engagement planning

- We provided our Client with a detailed proposal outlining costs breakdown, time frame, and accounting and tax liabilities. All fees were agreed upfront so there would be no hidden charges to our Client;

- Healy Consultants Group sent a draft corporate structure and business plan for our Client review, amend as required and email return; Healy Consultants Group supplied weekly detailed engagement status updates on the engagement progress;

- Healy Consultants Hong Kong’s office will be the company secretary and legal registered office;

- Based on our Clients’ requirements, Healy Consultants Group contacted multiple banks in Singapore for the initial introduction of our Client’s business and their need for a non-resident multicurrency corporate bank account.

Hong Kong offshore LLC company incorporation

- Once we received payment and the due diligence documents and reviewed them to ensure that the Client is a legitimate businessperson, Healy Consultants Group began the registration process;

- Healy Consultants performed a name search with CR Hong Kong. Upon confirmation of company name availability, Healy Consultants prepared full set of incorporation documents to be signed by our Clients and submitted to CR for incorporation;

- Healy Consultants also agreed to act as the company secretary for our Client’s company, to meet statutory requirements of the Hong Kong Companies Act. Company incorporation was completed within 4 weeks from the start of this engagement.

Singapore corporate bank account opening

- Healy Consultants Group approached multiple Singapore banks to secure in writing their interest in welcoming a corporate bank account opening application from our Client;

- Our Client signed the final business plan to be submitted to the banks for review;

- Healy Consultants Group emailed our Client a proposed meeting agenda with the two banks keen to welcome an application from the Client’s Firm. Client arranged travel to Singapore;

- After our Client’s meeting with the banks and multiple requests from the banks’ compliance teams, the accounts were opened within 8 weeks;

- Within 4 weeks thereafter, our Client also received the internet banking tokens at their country address.

Engagement completion

- Once the above was complete, Healy Consultants Group couriered our Client a complete company kit, including i) unopened bank correspondences; ii) additional engagement related documents; and iii) Healy Consultants Group’s feedback survey.

-

Establishing Hong Kong based advertising and marketing campaign company

Background

- In 2018, our Client approached Healy Consultants Group to set up a Hong Kong company and open an international multi-currency corporate bank account;

- The Hong Kong company was planned to specialize in developing an online marketing strategy that assists customers to laser focus on their target market, raise brand awareness and promote digital presence in social media. The Hong Kong company would provide a comprehensive range of services to support digital presence of its customers all over the world.

Engagement planning

- Before starting the process, our Client i) settled the invoice and ii) provided complete due diligence documents and signed our Client Engagement Letter;

- Healy Consultants Group provided our Client with a detailed proposal outlining costs breakdown, time frame, and accounting and tax liabilities. All fees were agreed upfront so there would be no hidden charges to our Client;

- Healy Consultants Group sent a draft business plan and corporate structure of the new company for our Client review, input and email return;

- Healy Consultants Group supplied weekly detailed engagement status updates on country progress;

Company registration process

Upon confirmation of the corporate structure, Healy Consultants Group incorporated the Hong Kong company within one week and without the need our Client to travel to Hong Kong. Healy Consultants Group then proceeded to contact multiple international banks to secure a formal interest to submit the corporate bank account opening application forms;

Solutions with Switzerland Bank

- Within 2 weeks from the company incorporation, an African Bank confirmed their interest to accept formal corporate bank account opening application forms from our Client. Following the same, Healy Consultants Group closely liaised with bank officer and provided KYC documents and signed corporate bank account opening application forms;

- Despite Healy Consultants Group timely and aggressive follow ups, the bank did not provide timely feedback on corporate bank account opening process. Due to unexpected challenge, Healy Consultants Group immediately sources multiple alternative corporate bank account solutions and secures formal interest from a Swiss bank. Healy Consultants Group provides all required KYC documents and signed corporate bank account forms;

- Within 4 weeks, Healy Consultants Group’s corporate banking team i) liaised with our Client to provide detailed information to questions requested by the Bank ii) arranged a video call interview between our Client and the Bank. Subsequently, the Swiss Bank confirmed corporate bank account numbers. Within 2 weeks thereafter, our Clients also received the internet banking tokens directly at their Indian address.

Conclusion

Healy Consultants Group successfully effectively completed the Hong Kong company setup and secured multi-currency corporate bank account without our Client’s need to travel to Hong Kong and Switzerland. Thereafter, we mailed the Client complete company kit including i) a complete Client file; ii) corporate documents; iii) a Client feedback survey and iv) arranged a separate courier of corporate bank account e-banking tokens from Switzerland to our Client’s preferred address. Throughout the engagement, Healy Consultants Group has aggressively and skillfully negotiated with multiple banks. We timely responded to all unforeseeable challenges raised from international banks.

-

Hong Kong company registration and corporate bank account opening

Background

- In 2018, our Client approached Healy Consultants Group to open a Hong Kong company and a local corporate bank account. The company was incorporated by two entrepreneurs with already established successful business in Bangladesh;

- The main products offered are software applications sold over mobile platforms including Apple App Store and Google Play Store, targeting various Client bases around the globe.

Engagement planning

- We provided our Client with a detailed proposal outlining costs breakdown, time frame, and accounting and tax liabilities. All fees were agreed upfront so there would be no hidden charges to our Client;

- Healy Consultants Group sent a draft business plan for our Client review, input and email return; Healy Consultants Group supplied weekly detailed engagement status updates on country progress;

- Based on our Clients’ requirements, Healy Consultants Group prepared company registration forms with the Companies Registry in Hong Kong;

- After receiving the company numbers, Healy Consultants contacted multiple banks in Hong Kong for bank account meetings and prepared a detailed agenda for the client;

- Healy Consultants Group sent a staff to accompany the client with the comprehensive bank meetings in Hong Kong;

Company registration and corporate bank account opening

- Before starting the process, our Client i) settled the invoice; and ii) provided the completed and signed engagement letter;

- Our client also provided due diligence documents including i) latest proof of address ii) latest 6-months bank account statements iii) latest passport copy iv) sales and purchase invoices as supporting documents to show the business’s clients and suppliers and v) business contracts as proof of ongoing business;

- Healy Consultants registered the company online with Companies Registry after successfully receiving the incorporation forms;

- After incorporation, Healy Consultants Banking team was discussing with multiple local Singapore and Hong Kong banks to open a corporate bank account for the business. The banks were reluctant to open a business bank account for our Client because of the i) company’s incorporation country and also ii) lack of physical store;

- Our Client travelled to Hong Kong to visit 6 local and international banks. Because the Hong Kong banks were more responsive to our Client’s business and the banks require a one-hour face to face meeting with the company owners and directors, travel was compulsory;

Challenges and solutions: HSBC corporate bank account opening

- Healy Consultants liaised with the HSBC bank officer to proceed with the corporate account application. Within 1 week, Healy Consultants Group exchanged the requested KYC documents with the HSBC Bank officer and liaised with the Client to arrange a meeting in Hong Kong;

- In June 2018, our Client travelled to Hong Kong, along with a Healy Consultants staff, Ms. Rashi Mittal, to meet the HSBC officer. During the meeting, our Client and the bank officer discussed the i) potential business activity of the company; ii) details of expected incoming and outgoing transactions; and iii) KYC on the directors, shareholders and UBOs;

- After 3 weeks and multiple follow ups from the Healy Consultants Banking team, the HSBC bank account application was approved, and the bank account numbers were emailed directly to our Client. Within 2 weeks thereafter, our Clients also received the internet banking tokens directly at their Indian address.

Conclusion

- Throughout the engagement, Healy Consultants Group has aggressively and skillfully negotiated with multiple banks in Singapore. We timely responded to all unforeseeable challenges due to the nationality of our client;

- Every week, Healy Consultants Group provided our client a detailed engagement status update, outlining tasks to be completed, problems encountered and suggested solution.

-

A Client with a focus of trade in specialised medical equipment forms an offshore LLC entity in Hong Kong

Background

- Our Client trades in specialized medical equipment such as; general medical, surgical and disposable hospital supplies, medical equipment and baby care requisites. Our Client facilitates negotiations with global suppliers to source demanded resources for their Middle-East and Asian based medical professional Clientele;

- Our Client found Healy Consultants Group’s business website through Google, and rang us in May of 2018 to determine if our Firm could assist them with their requirements;

- After meeting with Kunal Fabiani who thoroughly assessed the Client’s needs, provided consultation and a roadmap on how to achieve the Client’s unique requirements, being an entity incorporated in Hong Kong with a Singapore based corporate bank account, the Client decided to proceed and engage Healy Consultants Group for their business setup.

Engagement planning

- After agreeing the corporate structure and minimum share capital to be paid up, Healy Consultants Group prepared a detailed engagement project plan mapping out a step by step plan to complete the engagement from the planning phase through to delivering the Client’s complete company kit to their preferred international address;

- A quality and detailed business plan was also prepared by Henry Beck to assist our Client obtain a multi-currency corporate bank account in Singapore.

Company registration

- Once planning for the engagement was successfully completed, Kunal checked and confirmed the availability of our Clients preferred company name on ICRIS, and Henry prepared the company incorporation documentation for the Client to sign. These forms included the NNC1, director appointments resolutions and owner declarations;

- After receipt of the signed incorporation documents, Healy Consultants Group submitted the same to the Hong Kong Companies Registry. Within a week the Client’s company was successfully incorporated.

Corporate bank account opening

- Henry compiled a list of banks in Singapore to be interested in business profiles similar to that of its Client’s and approached them;

- Over the course of 2 weeks, discussions were held with these banks to secure interest in onboarding our Clients Hong Kong entity. Although challenging due to the offshore nature of the Clients’ business, within an additional week, Henry secured confirmation of interest from multiple banks in welcoming an application from the Client’s business. Upon reviewing the initial set of due diligence documentation, the banks requested a face to face meeting with the Client in order to satisfy their KYC requirements and advance the account opening application.

- As there was a short delay in the Client’s ability to travel to meet with the banks, the bank account meetings were only attended to 3 weeks later. The Client met with each bank to understand their offerings and to sign the bank account opening forms. After completing the meetings, our Client selected a reputable and large local bank to be their banking partner in Singapore;

- As this was a newly formed, offshore corporate entity, the bank’s compliance department performed lengthier then usual due diligence checks on the Client, reverting for further documentation requests which delayed the process even further as the Client had to compile the same. After retrieving all the requested due diligence documentation required by the bank, within 2 weeks, the bank confirmed our Client’s account had been successfully opened.

Engagement completion

- The bank couriered the online banking tokens to the Client’s Hong Kong registered office. Henry then arranged for the same to be couriered to Healy Consultants Group’s Dubai office.

- Upon receipt of the online banking tokens in Dubai, the same was then compiled into a company kit which contained all of the Client’s newly incorporated Hong Kong entities’ corporate documentation, and was then couriered to the Client, completing the engagement.

-

Hong Kong Trading Company Registration

Background

- In March 2018, our Client contacted Healy Consultants Group to project-manage their Hong Kong company registration with a corporate bank account in Singapore;

- Their planned business activities for the newly registered company included selling of outdoor equipment and uniforms used in the commercial industry;

- The company’s main clients are based in South East Asia and suppliers are based in China.

Engagement planning

- Our Client engaged Healy Consultants Group to register a company in Hong Kong trading outdoor equipment and company uniforms;

- Our Client has over 30 years’ experience working as a production director with international companies as well as managing special projects;

- The Hong Kong company would have one international director and shareholder, with Healy Consultants Group’s Hong Kong office as the company secretary and legal registered office;

- We provided our Client with a detailed proposal outlining costs breakdown, time frame, and accounting and tax liabilities. All fees were agreed upfront so there would be no hidden charges to our Client.

LLC company incorporation

- Once we received payment and the due diligence documents and reviewed them to ensure their authenticity, Healy Consultants Group began the registration process;

- Healy Consultants performed a name search with Hong Kong Companies Registry (CR). We then drafted the detailed M&AA for the new Hong Kong company;

- Upon confirmation of company name availability, Healy Consultants Group prepared the full set of incorporation documents to be signed by our Clients. Thereafter, we submitted the application to the Hong Kong authorities;

- Healy Consultants Group also agreed to act as the Hong Kong resident company secretary for our Client’s company, to meet statutory requirements of the Hong Kong Companies Ordinance. Company incorporation was completed within 2 weeks from the start of this engagement.

Corporate bank account

- With our client’s travel to Singapore for a day, Healy Consultants Group arranged multiple bank meetings for him to complete the bank KYC requirements and to sign the account opening forms;

- Two weeks after our Client’s travel, Healy Consultants Group successfully secured a corporate bank account with a leading regional bank Singapore;

- Within two weeks thereafter, Healy Consultants Group received the bank mail and internet tokens (in sealed envelopes) and we arranged the same to be couriered to our Client’s address at no additional charges.

Accounting and taxation

- Immediately after the company was incorporated, Healy Consultants Group entered this company into our Hong Kong accounting and taxation database to ensure the company’s legal obligations would be timely discharged in the future;

- Again, we gently reminded our Clients of their legal obligations as the directors of a Hong Kong company;

- Next year onwards, Healy Consultants Group will prepare audited annual reports for submission upon receipt of the management accounts, invoices and bank statements from their company.

Conclusion

Healy Consultants Group was happy to assist our Clients establish their Hong Kong company according to their requirements.

-

Assisted a Big Law Firm to register a Hong Kong entity within 1 day

Background

- A big Global law firm contacted Healy Consultants Group on Sunday 3rd June 2018 to register a Hong Kong company within 1 day for their USA Client;

- They had submitted a company registration application 1 week before but unfortunately the company was not yet registered. Consequently, they were in urgent need of registering the company in less than 24h to be able to make business deals on Monday 4th June at 3pm.

Engagement planning

- After a long call with our Client on Sunday, Healy Consultants Group prepared and emailed our Client an engagement advancement proposal including a formal invoice, engagement letter and due diligence checklist;

- We also recommended our client to keep the company structure simple, as to avoid HK Government delays;

- Our Client agreed with our recommendations, provided us scans of the due diligence documents and settled the invoice in full within 1 hour.

Hong Kong company LLC incorporation

- On Sunday, Healy Consultants Group also prepared the Hong Kong legal incorporation forms and sent the same for our Client’s signature and email return;

- On Monday 10am in the morning, Healy Consultants Group secured a notarized copy of the passport of sole director and shareholder of the company. This notarized passport copy must be certified by a local Hong Kong public notary;

- Immediately thereafter our team prepared and submitted a quality incorporation application to the Hong Kong Government;

- At 1pm the Hong Kong company was successfully registered. Healy Consultants emailed our Client i) a set of the Hong Kong company documents and ii) our Client satisfaction survey. Our Client was now able to sign business contracts using his newly registered Hong Kong entity.

-

Investment company for Art Consultancy

Background

Our Client has been in the business of art consultancy for over 15 years. He specializes in alternative assets such as i) fine art, ii) rare coins, iii) rare books and iv) collectible stamps, assisting high wealth individuals through the entire process of securing, acquisition, storage and sale of the above mentioned assets.

Through these consultancy services, he assists his customers to i) diversify their portfolio, ii) inflation hedge, iii) take advantage of tax benefits, iv) reduce volatility. He services also aim at enabling professional art collectors receive financial gains while pursuing their hobby.

Our Client decided to set up a Hong Kong company as an investment holding company which will be used by the Client as a conduit for his art consultancy business based in Spain.

Engagement planning

Our Client approached Healy Consultants and explained his existing business and his plans with a Hong Kong company. Healy Consultants assisted the Client in determining the optimum corporate structure for his company in Hong Kong.

Healy Consultants recommend the Client allow our banking team to secure in writing, welcome emails from banks to increase probability of corporate bank account opening before incorporating the company. The Client agreed with this strategy.

Bank welcome email

Healy Consultants wrote a detailed business plan detailing the i) company’s profile, ii) business activities and iii) expected transaction volume. With the business plan, our banking team approached several local and international bank to confirm their interest.

Company incorporation

Upon receiving welcome emails from a number of Singapore banks, Healy Consultants proceeded to reserve the proposed company name with Hong Kong Companies Registry and thereafter incorporated the company with the signed NNC1 forms.

Additionally, to comply with Hong Kong New Companies Ordinance, our Client also decided to use our virtual office services for a legal registered office in Hong Kong where all official Government communications and notices may be addressed.

Corporate bank account

With the company successfully incorporated, Healy Consultants quickly proceeded to apply for corporate bank account opening with the registered company. Our banking team provided the local bank officers with their requested due diligence including i) corporate documents and ii) existing contracts from Client’s art consultancy business. By timely providing additional information and supporting documents, Healy Consultants was able to complete the banks ‘Know Your Clients’ procedures and secure the bank account numbers within 4 weeks.

-

Aviation consulting firm capturing global market

Background

Our Client, Mr. Trung has been working as a management consultant in the airline industry in Vietnam for over 15 years. As his reputation and success grew across border, he wished to set up an international entity in a reputable, cost effective jurisdiction to expand his business and close contracts with global clients.

Engagement planning

Based on his requirements, Healy Consultants proposed several corporate structures, along with their key advantages and disadvantages. Finally, we both agreed that a Hong Kong international company with corporate bank account in Singapore would be the most beneficial, given the nature of our Client’s business. Mr. Trung would be the sole shareholder and director of the company, and Healy Consultants Hong Kong would be the company’s secretary. We provided our Client with a detailed proposal outlining costs breakdown, time frame, and accounting and tax liabilities. All fees were agreed upfront so there would be no hidden charges to our Client.

We also convened a phone conversation to assure him of our competency and professionalism. Much to our surprise, Mr. Trung decided to book the flight ticket from Vietnam to Singapore to visit Healy Consultants office the very next day.

Within 24 hours, Healy Consultants prepared full set of incorporation documents to be signed by Mr. Trung and submitted to the Hong Kong Companies Registry. We also reviewed Mr. Trung’s due diligence documents to ensure that he is a legitimate business person. The whole process took under 1 hour to complete.

Corporate bank account

One major challenge of the engagement was Mr. Trung could only spend roughly 5 hours in Singapore. He needed to return to Vietnam in the evening to catch a flight to the U.S. Thanks to Healy Consultants’ excellent relationship with Singapore banks, we were able to arrange meetings with 3 major banks in Singapore given such a short notice. Healy Consultants guided Mr. Trung through the banks’ interviews and helped him fill in and sign the account opening forms. Because of our expertise and experience, we were able to convince the bankers despite that the company was not incorporated yet at the time.

After Mr. Trung left Singapore, Healy Consultants completed all relevant paperwork on behalf of him and settled payments with the banks. Two weeks later, Healy Consultants received approval and account details from 2 out of 3 banks. We immediately couriered the bank mails and internet tokens (in sealed envelopes) to Mr. Trung’s address in the U.S at no additional charges.

Company incorporation

The day after the meeting, Healy Consultants performed a name search with the Hong Kong Companies Registries (CR). Upon confirmation of company name availability, we submitted the incorporation documents prepared previously. This process was hassle-free for the Client as there was no need for him to sign any additional documents thanks to our superb engagement planning. The client just made one payment with Healy Consultants and we took care of the rest.

Accounting and taxation

Immediately after the company was incorporated, Healy Consultants entered his company into our Hong Kong accounting and taxation database to ensure the company’s legal obligations would be timely discharged in the future. Again, we gently reminded Mr. Trung of his legal obligations as the director of a Hong Kong company. Next year onwards, Healy Consultants will prepare audited annual reports for submission upon receipt of the management accounts, invoices and bank statements from his company.

-

Mexico hospitality business registers Hong Kong company to trade with China

Background

Our Client, Antonio is in the hospitality sector serving as the operations director for a chain of restaurants and a hotel in Mexico. Antonio approached Healy Consultants to assist registering a company in Asia for the purchase of high quality -low cost materials from China including furniture, linens, kitchenware and glassware. The Hong Kong company would purchase these materials from Chinese suppliers and resell them to the hotel.

Engagement planning

Healy Consultants initially provided our Client with costs breakdown, timeframe and accounting and tax liabilities to register a new Chinese WFOE in Shenzhen. However, our Client preferred a more tax effective structure that allowed the company to effectively trade with Chinese suppliers. Over a telephone conversation, we agreed with our Client the optimum corporate structure would be a Hong Kong non-resident company. Further our Client mentioned they needed to sign contracts and place purchase order with suppliers almost immediately, consequently Healy Consultants offered the option to purchase a Hong Kong turnkey solution with an already open Hong Kong HSBC multicurrency bank account.

The fast solution would enable our Client share the company details (Certificate of incorporation and Business Registration Certificate) with suppliers as soon as he settled engagement fees and provided complete due diligence. Healy Consultants advised our Client would only be able to operate the bank account once the bank signatory was officially changed in the bank’s record and this would take between 4 to 7 weeks to process. Our client accepted the engagement timelines and costs and decided to engage Healy Consultants.

Corporate structure and bank signatory changes

To change the corporate structure, Healy Consultants prepared and emailed our Client the appropriate share transfer form (Bought and Sold Note), form ND2A for directorship changes and board resolutions with accompanying signing instructions. To change the bank signatory, our Client was required to visit a HSBC branch in Mexico to certify his i) passport ii) proof of address and iii) signature. Once all documents were correctly signed, certified and approved by Healy Consultants via email, our Client couriered originals to our office in Singapore.

The new bank signatory was approved within 4 weeks, as promised, and in an additional 3 weeks Healy Consultants received the new internet banking token. Healy Consultants then proceeded to change the corporate structure of the readymade Hong Kong company by submitting signed documents and due diligence to the Inland Revenue Department and Companies Registry. Our Client was formally appointed as sole director and shareholder within 1 week. Healy Consultants thereafter submitted the updated company structure information to HSBC bank to update internal records.

Accounting and tax and engagement completion

Healy Consultants advised Antonio to keep substantial records of all transactions and accounts for Healy Consultants to efficiently complete Hong Kong government reporting on his behalf in the next taxable period. The expected documentation includes client and supplier invoices, expenses and disbursements. Healy Consultants further advised Antonio to seek independent legal and tax advice to determine the shareholders, director and beneficial owner personal and corporate tax obligations in Mexico.

Finally, to complete the engagement, Healy Consultants couriered a company kit to our client including the original Certificate of incorporation, business registration certificate, Memorandum and Articles of Association and original share transfer forms files with the Companies registry. The company kit also included a banking kit comprising the internet banking token, login instructions and original bank correspondence received from HSBC up to date.

-

South Africa's consulting firm turns to Hong Kong turnkey solutions

Background

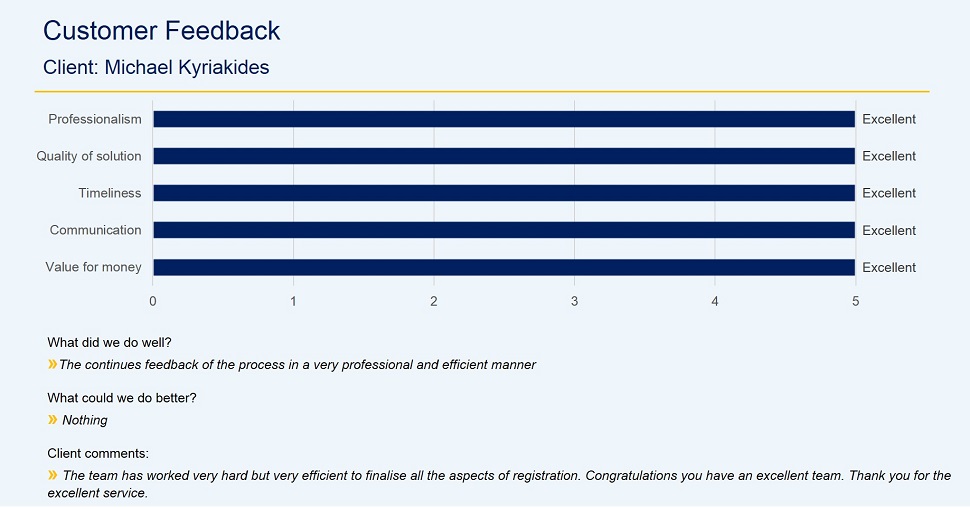

Our client, Mr. Michael Kyriakides, who is based in South Africa, runs his successful international consulting firm, specializing in architectural projects, civils, electrical and green energy, solar, bio-energy. He wished to have a Hong Kong company with a ready bank account in order to close a deal immediately in Asian lucrative consulting markets. Having found Healy Consultants business website through Google, he approached Healy Consultants. In an e-mail and subsequent telephone conversation with Healy Consultants, Mr. Kyriakides outlined his business strategy, which is to locate in Hong Kong to capture a significant share of the growing demand for engineering consulting.

Engagement planning

Given these details, Healy Consultants sent Mr. Kyriakides a detailed cost proposal to purchase a Hong Kong company with a ready bank account. The proposal included a step-by-step engagement overview to ensure that there would be no surprises for Mr. Kyriakides. And based on this proposal, the engagement began with Mr. Kyriakides signing our Client Engagement Letter. In the letter, Mr. Kyriakides outlined his required corporate structure for the Hong Kong Company, with himself acting as sole shareholder and Healy Consultants acting as the nominee director and Hong Kong resident company secretary. Afterwards, Mr. Kyriakides provided Healy Consultants with due diligence and settled our engagement fees.

Corporate structure change

Upon receipt of the signed engagement letter, 100% full payment and 75% due diligence documents, Healy Consultants emailed Mr. Kyriakides with the Certificate of Incorporation from the Hong Kong Companies Registry (CR) and the bank account details from the Hong Kong bank immediately. While Mr. Kyriakides visited Hong Kong, Healy Consultants prepared the secretary forms and resolutions regarding the company structure change for Mr. Kyriakides’s signature in our Hong Kong office. On the same day, Healy Consultants arranged a meeting for Mr. Kyriakides with HSBC Hong Kong bank branch. In this meeting, Hong Kong bank captured his signature on signature card. Upon receipt of the signed documents, Healy consultants submitted them to the CR, along with payment for US$550 to cover government registration fees. Five days later, Healy Consultants received a full set of approved corporate documents from the CR, which was forwarded immediately to Mr. Kyriakides. One week after changing company structure, Healy Consultants couriered Mr. Kyriakides the original company kit containing the Certificate of Incorporation, Memorandum and Articles and share certificates.

Corporate bank signatory change

Once receiving the signed bank forms and the approved corporate documents from the CR, Healy Consultants submitted the corporate bank account forms and the required corporate documents to the Hong Kong bank. Two weeks after the submission, Healy Consultants received an approval letter for Mr. Kyriakides as a sole signatory of the corporate bank account. The previous bank token and bank signatory were cancelled and removed from this account immediately. In the following two weeks, Mr. Kyriakides received (in sealed envelopes) a new token with internet banking passwords and PIN numbers, a corporate ATM card and PIN numbers. From this moment on, Mr. Kyriakides has become the sole beneficial owner and bank signatory for this Hong Kong company.

Virtual office services

To support Mr. Kyriakides’s company, Healy Consultants provides a full Hong Kong virtual office service. This includes telephone answering and mail forwarding service, enabling him to keep in close contact with his Clients and suppliers around the world. This is especially important since Mr. Kyriakides continues driving his international business from South Africa.

Accounting and tax support

Healy Consultants will complete our Client’s company accounting, auditing, legal and tax obligations. Healy Consultants will obtain a simple trial balance from our Client, together with email copies of invoices and bank statements. Immediately thereafter, Healy Consultants will prepare an annual report (10-page financial statements) together with supporting notes in compliance with Hong Kong Financial Reporting Standards. The financial statements will be reviewed and approved by Mr. Kyriakides, and submitted to independent Hong Kong auditors. Following receipt of an unqualified audit report, Healy Consultants will courier a complete tax return to Mr. Kyriakides for his signature. Upon return of the same, our Accounting Department will prepare a tax computation, together with supporting tax notes. A complete package will be couriered to the Hong Kong Inland Revenue Department (IRD), who will reply with a tax assessment stating legal tax exemption on corporate profits.

-

Architectural services firm eyes new-generation China projects

Background

Our Client, Aljosja, who is based in the Netherlands, runs an architectural services company which has been involved in some of the most important contemporary construction projects ever completed in Europe. The company specialises in urban and environmental planning, landscape architecture, interior design and related consulting services. Although Aljosja’s company has worked on key projects in the Middle East (notably hotel projects in Dubai and Qatar), he has to date not had the resources to penetrate Asian markets. However, our Client has long recognised the potential of Asian economic growth in recent years, including the regional construction boom. Of particular interest to Aljosja was the high-end, cutting-edge construction sector in China, where growing demand exists for niche architectural services.

Engagement planning

Aljosja approached Healy Consultants to find out how we could turn his regional ambitions into reality. Aidan Healy, managing director of Healy Consultants, convened a telephone conversation with Aljosja to explain the various options available to him to allow him to efficiently conduct business in China, and the legal, tax and accounting implications of doing so. After a detailed consultation, it was decided that a Hong Kong company would best suit Aljosja’s requirements. Hong Kong is an excellent gateway into China (particularly its southern provinces). In addition, setting up a company in China itself is both time consuming (due to the many regulations and licensing requirements) and expensive (given the high initial capital requirements compared to Hong Kong). Aljosja also planned to market his services throughout Asia, and a Hong Kong company would be a more internationally-respected, tax-efficient corporate structure through which to do this.

Corporate structure

It was agreed that Aljosja would be sole shareholder and director of the Hong Kong company, and that Healy Consultants would be the Hong Kong resident company secretary. On this basis, Aljosja signed our Client Engagement Letter, settled our engagement fees and provided the due diligence required as part of Healy Consultants’ ‘Know Your Client’ policy. With this achieved within a week, Healy Consultants performed a name search with the Hong Kong Companies Registry (CR), to check whether our Client’s preferred company name was available. We received confirmation two days later, and reserved the name.

Company incorporation

On the same day, Healy Consultants prepared pre-incorporation documents, including the memorandum and articles of the proposed company, a statutory declaration by an officer of the company and directors’ and shareholders’ consent. These ere couriered to Aljosja in the Netherlands for his signature, and were returned to our Hong Kong office within one week. Upon receipt of the signed documents, we submitted them to the CR, along with payment for US$350 to cover government registration fees. Five days later, we received an e-mailed Certificate of Incorporation from the CR, which was forwarded immediately to Aljosja. The following day, Healy Consultants filed the Notification of Appointment of First Directors and Secretary, a Letter of Appointment of First Directors and signed consent to act as director to the CR. We also obtained a Business Registration Certificate from the CR. One week after incorporation, Healy Consultants received the original company kit containing the Certificate of Incorporation, Memorandum and Articles and share certificates.

Corporate banking

Two weeks after the engagement started, Healy Consultants approached an international bank in Hong Kong to open a multi currency corporate bank account on behalf of Aljosja’s company. Our Client was, at this time, busy supervising an important project in Germany, and was therefore grateful that Healy Consultants was able to assist him to open the account without him needing to visit Hong Kong. We prepared a corporate bank account application form on behalf of Aljosja’s company, in addition to a detailed business plan to accompany the application, explaining the company’s activities and why it required a corporate bank account in Hong Kong. Opening a bank account in Hong Kong is difficult and the banks have strict due diligence requirements. For example, the bank requires proof of existing business (e g contracts or invoices in the name of the company, websites and brochures). Since the Hong Kong company was incorporated just one week prior to account application, this was difficult to generate. However, we found a suitable workaround solution which satisfied the bank’s requirements. Three weeks after submitting the corporate bank account application, Healy Consultants received an account number for Aljosja’s company. In the following two weeks, we also received (in sealed envelopes) the Internet banking passwords and PIN numbers, a corporate ATM card and PIN numbers.

Virtual office services

To support Aljosja’s company, Healy Consultants provides a full Hong Kong virtual office service, including telephone answering and mail forwarding services. Since Aljosja remains based in Europe, this service provides him with a vital link to his potential Clients in Asia during their business hours.

Accounting and tax support

Healy Consultants completed our Client’s company accounting, auditing, legal and tax obligations. We obtained a simple trial balance from our Client, together with email copies of invoices and bank statements. Immediately thereafter, we prepared an annual report (10-page financial statements) together with supporting notes in compliance with Hong Kong Financial Reporting Standards. The financial statements were reviewed and approved by Aljosja and submitted to independent Hong Kong auditors. Following receipt of an unqualified audit report, Healy Consultants couriered a complete tax return to Aljosja for his signature. Upon return of the same, our Accounting Department prepared a tax computation, together with supporting tax notes. A complete package was couriered to the Hong Kong Inland Revenue Department (IRD), who replied with a tax assessment stating legal tax exemption on corporate profits.

-

Banking recruitment firm enters Hong Kong market

Background

Andrew is the managing director of a multinational professional recruitment firm, specialising in locating permanent and temporary staff for some of the world’s leading banks. It is headquartered in Australia and operates in 15 countries in key markets around the world. The company approached Healy Consultants with a remit to expand its ground operations in Asia in response to strong regional growth in financial services. The Client believed the company would be better able to meet its Clients’ needs by setting up a physical base, and on this basis Healy Consultants provided expert advice. Since the bulk of its regional bank Clients are in Singapore or Hong Kong, Andrew preferred to focus on these two financial centres. Furthermore, since rapid economic growth in China was creating soaring demand for private banking services from wealthy Chinese citizens, he believed Hong Kong would be the natural location for the company.

Engagement planning

Andrew visited Healy Consultants’ Singapore office to confirm his business strategy and begin the engagement. Healy Consultants’ managing director Aidan Healy had already explained by e-mail to Andrew the tax advantages of being located in Hong Kong, as well as the legal and accounting obligations. However, during the meeting Andrew was able to identify the additional services he would require following company incorporation, and as such total engagement fees were agreed. Andrew signed Healy Consultants Client Engagement Letter, outlining his required Hong Kong corporate structure, with the US branch acting as sole shareholder and Andrew and his US-based colleague Michael as directors. Healy Consultants Hong Kong office would provide company secretary services for the company to meet the statutory requirements of the Hong Kong Companies Ordinance.

Company incorporation

Healy Consultants performed a name search with the Hong Kong Companies Registry (CR), and upon confirmation we prepared Hong Kong incorporation forms, including the memorandum and articles of the proposed company, a statutory declaration by an officer of the company and directors’ and shareholders’ consent. These were emailed to Andrew with detailed signing instructions for both his and Michael’s signatures and return to Hong Kong. Time delays between transferring the documents between Andrew in Australia to Michael in the US slowed the engagement. Upon receipt in Hong Kong, however, we submitted the signed documents to the CR, and paid the government registration fee of US$350. Five days later, Healy Consultants received an e-mailed Certificate of Incorporation from the CR, which was forwarded on the same day to Andrew. The next day, we filed the Notification of Appointment of First Directors and Secretary, a Letter of Appointment of First Directors and signed consent to act as director to the CR. Healy Consultants also obtained a Business Registration Certificate from the CR and one week after incorporation of the company, the original company kit containing the Certificate of Incorporation, Memorandum and Articles and share certificates was received by us.

Corporate banking

Andrew required a corporate bank account in both US and Hong Kong currencies and with excellent Internet banking facilities. Thanks to our excellent relationship with Hong Kong banks, neither Andrew or Michael were required to travel to Hong Kong to open the account. We completed a corporate bank account application pack, comprising a completed application form, a signed business plan describing the company’s activities and a brief market analysis, and corporate documents. Because Hong Kong banks apply increasingly strict due diligence standards, and since Andrew and Michael who would both be account signatories, it was necessary to support the application with notarised passport copies, bank and lawyers’ reference letters, proof of business (including letters of intent with potential Clients, company brochures and/or a business website). Healy Consultants submitted the application pack to the bank, and attended an interview to explain why the Client’s company required a Hong Kong corporate bank account. Three weeks later, we received an account number. In the following two weeks, we also received (in sealed envelopes) Internet banking passwords and PIN numbers, a corporate ATM card and PIN numbers. With the corporate bank account activated, Andrew was able to start invoicing Clients in Hong Kong.

Accounting and tax support

Annually, Healy Consultants efficiently and effectively completes Andrew’s Hong Kong company accounting, auditing, legal and tax obligations. Following the anniversary of company incorporation, Healy Consultants Accounting Department obtains a simple trial balance from our Client, together with email copies of invoices and bank statements. Immediately thereafter, Healy Consultants prepares an annual report (10-page financial statements) together with supporting notes in compliance with Hong Kong Financial Reporting Standards. The financial statements are reviewed and approved by our Client and submitted to independent Hong Kong auditors. Following receipt of an unqualified audit report, Healy Consultants couriers a complete tax return to Andrew for his signature. Upon return of the same, our Accounting Department prepares a tax computation, together with supporting tax notes. A complete package is couriered to the Hong Kong Inland Revenue Department (IRD), who reply within a few months with a tax assessment, usually stating legal tax exemption on corporate profits.

-

Commodities trader relocates to Hong Kong

Background

John is a global commodities futures trader specialising in Chinese minerals, including coal and precious metals. He has Clients around the world, including throughout Asia. Previously based in Vancouver, Canada, John wished to relocate to Hong Kong to be closer to some of his major clients, as well as benefit from Hong Kong’s tax advantages. John contacted Healy Consultants. His objectives were precise – to incorporate a company in Hong Kong which would allow him to conduct tax-efficient global trading; to open a corporate brokerage account with a reputable bank in Asia or internationally to facilitate his trading activities; to obtain a Hong Kong residence permit enabling him to live there, as well as ongoing assistance including help finding an apartment in Hong Kong and tax support for the Hong Kong company.

Engagement planning

John visited Healy Consultants’ Hong Kong office to discuss the best way forward for the engagement. Healy Consultants’ managing director Aidan Healy had already provided a detailed cost proposal based on John’s requirements, and it was on this basis that the engagement began with John signing our Client Engagement Letter. In the document, John outlined his required corporate structure for the Hong Kong company, with himself acting as sole shareholder and director and Healy Consultants acting as Hong Kong resident company secretary.

Company incorporation

We checked with the Hong Kong Companies Registry (CR) that John’s preferred company name was available, and then prepared Hong Kong incorporation forms, including the memorandum and articles of the proposed company, a statutory declaration by an officer of the company and directors’ and shareholders’ consent. Since John was in Hong Kong, he signed the documents, which we then submitted to the CR, in addition to paying the US$350 government company registration fee. Five days later, Healy Consultants received an e-mailed Certificate of Incorporation from the CR, which was forwarded on the same day to John, now back in Canada. The next day, we filed the Notification of Appointment of First Directors and Secretary, a Letter of Appointment of First Directors and signed consent to act as director to the CR. Healy Consultants also obtained a Business Registration Certificate from the CR and one week after incorporation of the company, the original company kit containing the Certificate of Incorporation, Memorandum and Articles and share certificates was received by us.

Corporate brokerage account

John required a corporate brokerage account to enable him to trade on the major Asian stock markets, including in Hong Kong, Singapore, Shanghai, Shenzhen, Tokyo and Australia. Healy Consultants works closely with a major international bank, which provides secure, online brokerage services to international Clients. We advised John in advance of the likely brokerage commissions charged by the bank, as well as any share transfer charges, prior to completing the brokerage account application form. Brokerage account opening was swift, and John was now ready to begin trading on behalf of Clients.

Corporate bank account

In addition to the brokerage account, John requested our assistance to open a corporate bank account. Since he was located in Hong Kong, we recommended a Singapore account, thereby ensuring that funds received by the Client’s Hong Kong company would be legitimately tax-exempt. We completed a corporate bank account application pack, comprising a completed application form, a signed business plan describing the company’s activities and a brief market analysis, and corporate documents. Because Singapore banks apply increasingly strict due diligence standards, and since John would be an account signatory, it was necessary to support the application with notarised passport copies, bank and lawyers’ reference letters and a proof of business (including letters of intent with potential Clients, company brochures and/or a business website). Healy Consultants submitted the application pack to the bank, and attended an interview to explain why the Client’s company required a Singapore corporate bank account. Two weeks later, we received an account number. In the following two weeks, we also received (in sealed envelopes) Internet banking passwords and PIN numbers, a corporate ATM card and PIN numbers. With the corporate bank account activated, John was able to start invoicing his international Clients.

Hong Kong employment visa

Healy Consultants completed an employment visa application form from the Hong Kong Immigration Department on John’s behalf. Furthermore, we prepared a detailed Business Plan to accompany the application, which detailed the company’s intended activities, its operational and marketing strategy for Hong Kong, as well as a detailed market analysis and financial projections. In the meantime, John located his educational qualifications, as required by the Hong Kong authorities. Visa approval was granted six weeks after the application was submitted.

Relocation to Hong Kong

Although John was a regular visitor to Hong Kong, and thus familiar with key points of interest, he required assistance in locating a suitable apartment-cum-office in the city. His preferred location was Deepwater Bay, a district close to the city centre on Hong Kong island. With the assistance of a real estate agent, Healy Consultants showed John a range of suitable properties meeting his specifications and budget, and within one week he had signed a property lease agreement.

Accounting and tax support

For the next 2 years, Healy Consultants efficiently and effectively completed John’s Hong Kong company accounting, auditing, legal and tax obligations. Following the anniversary of company incorporation, Healy Consultants Accounting Department obtains a simple trial balance from our Client, together with email copies of invoices and bank statements. Immediately thereafter, Healy Consultants prepares an annual report (10-page financial statements) together with supporting notes in compliance with Hong Kong Financial Reporting Standards. The financial statements are reviewed and approved by John and submitted to independent Hong Kong auditors. Following receipt of an unqualified audit report, Healy Consultants couriers a complete tax return to John for his signature. Upon return of the same, Healy Consultants prepares a tax computation, together with supporting tax notes. A complete package is couriered to the Hong Kong Inland Revenue Department (IRD), who reply within a few months with a tax assessment, usually stating legal tax exemption on corporate profits.

-

Steel trader sets up tax-efficient global structure

Background