Labuan legal and accounting and tax considerations in 2025

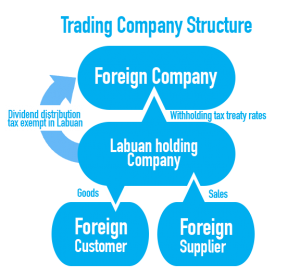

- Corporate tax in Labuan is levied only on trading companies at 3% of audited net profit for income sourced outside Malaysia. Non-trading (investment holding) companies are not subject to tax;

- Malaysia resident companies are subject to 17% corporate tax for chargeable income below MYR 500,000 and 24% for incomes above this threshold;

- Capital gains and import duties are completely exempt from capital gains tax in Labuan;

- Non-resident Labuan companies are exempt from indirect taxes such as VAT, sales tax, custom duties and GST. All resident Labuan companies making sales within Malaysia are levied indirect taxes in the form of GST at a rate of 6%;

- Income obtained from royalties and intellectual property received by a Labuan company is subject to 24% corporate tax rate;

- Tax returns must be filed by 31st March, or a 10% penalty will be imposed on the outstanding balance;

- There are no exchange controls imposed on Labuan offshore companies. Moreover, there are no restrictions on Labuan companies transacting with Malaysian residents in Malaysian Ringgit, including paying for their administrative or statutory expenses;

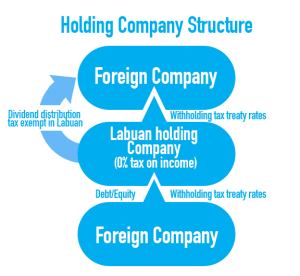

- Labuan based companies can take advantage of Malaysia’s double tax avoidance treaties with more than 73 countries including Australia, China, Singapore, UK and the United States;

- Healy Consultants Group will assist our Clients with i) documenting and implementing accounting procedures; ii) implementing financial accounting software; iii) preparation of financial accounting records; and iv) preparing forecasts, budgets, and sensitivity analysis;

- Clients need to note of their personal and corporate tax obligations in the countries of residence and domicile, and that they will fulfil these obligations annually. Let us know if you need Healy Consultants Group’s assistance to clarify your annual reporting obligations.

- The Labuan government has reduced the number of company activities which are eligible to claim 3% tax as part of the jurisdiction’s Economic Substance Requirements (ESR). There are now 21 permitted activities on the list, compared to 23 before.

- Because of the above, some companies are required to undertake an audit in Labuan and pay 24% tax under Income Tax Act 1967.

Healy Consultants Group’s Legal and Compliance department assists our Clients to fulfil their annual legal and tax obligations for their Labuan companies.

-

Company Regulations

- A Labuan offshore company requires at least 1 director and 1 secretary who are both resident in Labuan. Both positions can be held by the same individual. It also requires 1 shareholder who can be i) of any nationality and ii) an individual or a body corporate;

- A Labuan offshore company must appoint its resident company director and secretary either through i) a Labuan trust company; ii) a domestic company completely owned by the trust company or iii) a licensed or registered domestic company holding shares in a Labuan company. Healy Consultants Group will assist our Client’s firm to appoint a suitable Labuan legal entity;

- Prior approval is required from Labuan FSA for companies engaging in activities including i) Islamic financial services ii) banking iii) insurance iv) fund management v) leasing vi) factoring transactions and vii) accounting;

- An offshore company is not allowed to issue bearer shares;

- If the Malaysian word “Sdn. Bhd.” is used in the company’s name to denote limited liability, it must be preceded with a “L” to show that the company was incorporated in Labuan;

- It is compulsory for all Labuan companies to comply with annual audit obligations.

-

Staff Regulations

- The minimum wage in Labuan is US$265 per month;

- Employers must make monthly contributions of 12% of an employee’s remuneration to the employment provident fund. Non-compliance subjects employer to i) 3 years of imprisonment and/or ii) a fine of US$3,000;

- Each marketing office of a Labuan company cannot have more than four employees;

- Employees in Malaysia work 48 hours per week. Companies must provide one-day off a week;

- Companies with more than 40 employees must establish a joint labour-management safety committee for a safe, healthy workplace for its workers;

- Resignation notice period for employees who have worked with the company for less than 2 years is 4 weeks, between 2 and 5 years is 6 weeks and more than 5 years is 8 weeks;

- Labuan companies are required to pay their employees termination benefits. The benefit amount can be up to 20 days’ wages for each year of service;

- Before 31 March each year, each Labuan entity is legally required to file a return regarding employer and employee salary particulars (Form E and Form EA – employee residence in Malaysia) with the Malaysia tax authority (LHDN);

- This statutory filing requirement applies to all Malaysian and Labuan companies, even if they are dormant and have no staff;

- Our standard annual fee is US$350 for a company without staff and US$850 for companies with up to 20 staff.

-

Reporting Regulations

- A Labuan company must submit financial statements to an independent statutory annual audit;

- All Labuan companies can now freely conduct business with resident Malaysia companies and deal in Malaysian Ringgits directly. Transactions with Malaysian residents no longer need to be notified to the Labuan FSA.

-

Labuan economic substance requirements

All companies incorporated in Labuan that are carrying out any “Labuan business activity” must mandatorily meet the following requirements of:

- Having a minimum number of full-time employees in Labuan;

- Satisfying the minimum required annual operating expenditure in Labuan.

Please refer to the table below for a detailed insight regarding the minimum substance requirement for each company type:

S. No. Type of Labuan Company Minimum substance requirements for full time employees Minimum substance requirements for annual operating expenditure 1. Insurance company and Takaful operators 4 US$36,166

(RM 150,000)2. International commodity trading company 3 US$723,315

(RM 3,000,000)3. Banking and investment company 3 US$48,400

(RM 180,000)4. Trust company 3 US$28,933

(RM 120,000)5. Fund managing company 2 US$24,111

(RM 100,000)6. Leasing company 2 US$24,111

(RM 100,000)7. Holding company 2 US$12,055

(RM 50,000)8. Labuan Payment Service Operator Licensed company 2 US$24,111

(RM100,000)- If a Labuan company does not meet the minimum substance requirements laid out in the 2019 LBATA amendments then, the company will not be entitled to be taxed under the LBATA 1990. Instead, it will be liable to a corporate tax of 24% under the Income Tax Act 1967 of Malaysia;

- All Labuan companies are also required to have a physical office space in Labuan for its full-time employees;

- A dormant Labuan company is not required to meet the above minimum substance requirements.

-

Case study

-

Our ATD team completes Labuan accounting, tax and legal obligations

Background

Our Client’s principal business activity is payment system operations. The company was incorporated in August 2014 under the name of Healy Consultants Ltd in Labuan. In March 2020 the company was transferred to our Client, and the name was changed with the Labuan authorities.

Our Client required our assistance to renew the company’s business licence and complete its accounting, tax and legal obligations with the Labuan Financial Services Authority (LFSA).

Engagement planning and execution

- Our Client settled Healy Consultants Group’s Labuan company renewal invoice. We received confirmation of the funds transfer from our Group Financial Controller, Ms. Sharon Tham.

- A member of our Accounting and Tax Department (ATD) was then assigned to assist our Client to complete their Labuan company’s renewal, accounting and tax obligations.

- Labuan company renewal was completed within six months. The long time frame was because the company was required to prepare an audit financial report to comply with Labuan’s economic substance requirements.

- Our team informed our Client on the filing deadlines and deliverables required from them to advance the engagement. Upon receiving the deliverables (e g management account, bank statements, invoices) from our Client, we liaised with our independent auditor to advance the audit engagement until it was completed.

- Meanwhile, in between the ongoing engagements, the assigned ATD member liaised with the company secretary and the government to submit the annual legal statutory returns with the Labuan Financial Services Authority.

Engagement completion

Once the renewal obligation was completed, the ATD member sent an Engagement Completion e-mail to our Client. This included a ‘Summary of Obligations’ attaching the proof of government filings together with the final audit report.

-