Secure an EU visa in 2024

EU visa strategies

Healy Consultants usually helps our Clients’ secure one of the following visas:

| Entrepreneur visa | Investor visa | |

|---|---|---|

| Healy Consultants fees | €4,950 | €7,950 |

| Average timeframe to secure visa approval | 3 months | 5 months |

| Our client must travel before visa approval? | No | No |

| Visa validity | 2 years | 5 years |

| Can I be self-employed? | Yes | Yes |

| Additional residence/work permit required? | Yes | No |

| Long term residency available? | Not immediately | Yes |

| Local company required? | No | No |

| Local company recommended? | Yes | Yes |

| Residency through company incorporation? | Yes | Not required |

| Minimum funding investment/net-worth required? | Yes | Yes |

| Investment type | None | Real estate, Government stocks/bonds, Merger/Acquisition or JV with a EU company |

| Examples of EU entrepreneur visa | EU blue card Startup Delta |

NA |

Low cost EU visa strategies

View below a comparison of low cost company structuring options with migration solutions in Europe:

| Cyprus | Slovakia | Latvia | |

|---|---|---|---|

| Our order of preference | 1 | 2 | 3 |

| Fees to assist with EU visa application | €4,950 | €4,950 | €3,950 |

| Visa type | Employment and residence permit | Temporary residence permit | Self-employed residence permit |

| Visa validity | 2 years | 2 years | 1 year |

| Timeframe to secure visa approval | 2 months | 2 months | 2 months |

| Our client must travel before visa approval? | No | No | No |

| Can sponsor family on this visa? | Yes | Yes | Yes |

| Company formation considerations | |||

| Total year 1 estimated engagement costs | €12,485 | €7,900 | €11,890 |

| Total year 2 costs | €3,400 | €4,990 | €3,580 |

| Corporate tax payable | 12.5% | 21% | 20% |

| Timeframe to obtain company registration number | 2 weeks | 2 weeks | 2 weeks |

| Timeframe to secure corporate bank account number | 4 weeks | 4 weeks | 4 weeks |

| Total engagement period | 2 months | 2 months | 2 months |

| Our client must travel during the engagement? | No | No | No |

| Wholly foreign owned? | Yes | Yes | Yes |

| Minimum paid up capital | €1 | €5,000 | €2,800 |

| Resident director required? | No | No | No |

| Minimum number of directors | 1 | 1 | 1 |

| Minimum number of shareholders | 1 | 1 | 1 |

| Corporate shareholders allowed? | Yes | Yes | Yes |

| Corporate directors allowed? | Yes | Yes | Yes |

| Annual tax return to be submitted? | Yes | Yes | Yes |

| Annual financial statements required? | Yes | Yes | Yes |

| Statutory audit required? | No | No | Yes |

| Tax Identification Code required? | Yes | Yes | Yes |

| Allowed to issue sales invoices? | Yes | Yes | Yes |

| Allowed to sign contracts? | Yes | Yes | Yes |

| Allowed to import and export goods? | Yes | Yes | Yes |

| Allowed to rent office space in the country? | Yes | Yes | Yes |

| Can buy property in the country? | Yes | Yes | Yes |

| Total engagement costs | €12,485 | €7,900 | €11,890 |

| Draft invoice | View invoice PDF | View invoice PDF | View invoice PDF |

Different types of EU visas

-

Schengen visa (Tourist visa)

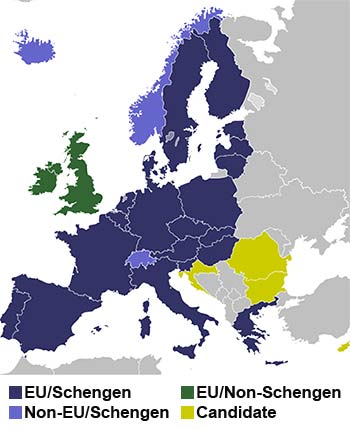

The Schengen Area includes 26 member states (22 countries of the European Union and 4 part of the EFTA). The Schengen area comprises most of the countries in Europe, allowing Schengen visa holders to travel with no border control imposed between the countries.Citizens of countries outside the Schengen zone can apply for a Schengen Visa at their designated Embassy/ Consulate or other authority in the country of origin. If traveling to more than one country within the Schengen zone, we recommend applying for the visa in the consulate of the country where you will be staying the longest.

There are two types of Schengen visas: i) Uniform Schengen Visa (USV) and ii) Limited territorial validity visas (LTV). The most common type of Schengen visa used is the USV which allows an individual to reside and transit within the Shengen zone for a maximum period of 90 days.

-

Golden investor visas

Several countries in the EU including Spain, Portugal, Greece, Malta, Hungary, Latvia, Ireland, UK and Cyprus offer a golden visa scheme for wealthy foreigners who wish to migrate to Europe. The criteria for obtaining a golden visa differs in each country. In general, applicants must invest amounts upwards of €250,000 either in real estate, companies or government bonds to obtain this visa which is issued for a period of 5 years, but can be prolonged.

-

Employment visas

Non- EU citizens who wish to work and reside in the EU countries must apply for country specific work and residence permits. Healy Consultants will be pleased to guide our Clients regarding the type of permit that best suits their needs and qualifications. We will also assist in preparing the application for these permits, whether you are applying as a “self-employed worker” or hiring foreigners as “employed workers” in your company.

- Austria – If our Clients intend to be self-employed in Austria, they can apply for a Red-White-Red card. This permit is applicable only if the applicant’s company in Austria is deemed creating macroeconomic benefit by i) providing regular investment capital to Austria ii) creates new jobs in Austria iii) introduces new technology in Austria and iv)the company is of considerable significance for the entire region.

Depending on the qualifications and length of stay, there are various types of residence titles available for employed workers including i) Red-White-Red card ii) Red-White Red Card plus iii) EU Blue Card and iv) residence permits. The general conditions one must meet to obtain any of these residency titles include i) accommodation in Austria ii) medical insurance and iii) means of subsistence in Austria.

- Belgium – Non- EU nationals who wish to work in Belgium must obtain a Long-stay visa (Type D). In addition to this visa, employed workers must obtain a work permit (Type B) whereas self-employed workers must obtain a professional card.

- Bulgaria – Self- employed and employed foreigners in Bulgaria must obtain i) a single/work permit ii) visa “type D” and iii) a residence permit.

- Croatia – Foreigners who wish to work in Croatia must obtain a work and residence permit. The applications can be submitted either by the applicant or the employer. Self-employed foreigners are not subject to the foreign employees’ quota.

- Cyprus – Self- employed foreigners must apply for an immigration permit. However, this is only applicable for people who have already been residing in Cyprus for a while. Employed foreigners need to apply for an entry permit, a temporary residence permit and an employment permit. Long term residence permits can be applied for only after 5 years of residence in Cyprus.

- Czech Republic – Clients who wish to be self-employed in the Czech Republic must obtain a business license and a long-stay visa. A long stay visa is valid only for 6 months. If our Clients wish to stay in the country for longer, they must apply for a long term residence permit before the visa expires. This permit is valid for 2 years. Employed workers on the other hand must apply for an employee card. These cards can be valid for up to 2 years after which it must be renewed.

- Denmark – Entrepreneurs must obtain a residence permit and a work permit if they want to reside in Denmark to run their Danish company. In order to apply for these permits, the applicant must prove that their presence and involvement in the operations of the business is crucial. Shareholders who only have financial interest in the company will not be granted the residence and work permit.

Employed workers will have to apply for a residence and work permit as well. These applications are considered based on local labor market conditions, applicant’s qualifications, pay etc.

- Estonia – Foreign owners of Estonian companies and employed workers can apply for a temporary residence permit. The government restricts the number of non-EU citizens who can be resident in Estonia. Only up to 0.1% of the Estonian population can be non-EU citizens.

- Finland – Depending on the nature of the work or the business, non-EU citizens who wish to be either self-employed or employed in Finland must apply for either a temporary (type B) or continuous (type A) residence permit.

Applications for self-employed residence permits are judged on i) business plan ii) signed preliminary contracts iii) applicant’s qualifications and iv) financing agreements. Applications for employed residence permits on the other hand are judged on i) means of subsistence ii) terms of work and iii) employer’s history and future capability in meeting obligations as an employer.

- France – Self-employed businessmen can either apply for i) a residence permit or ii) a circulation visa for non-resident directors interested in doing business in the EU. For investors incorporating a new company in France, they also have an option to apply for an exceptional economic contribution visa directly valid for 10 years. Applicants for this visa will have to either i) invest over €10 million or ii) create or save at least 50 jobs in the country.

Employed foreign workers must obtain a long-stay visa, work permit and a residence permit. The French employer must apply for an employment authorization with DIRECCTE while applying for these permits for their foreign employees.

- Germany – An application for a residence permit for the purposes of self-employment can only be made in Germany and not outside the country. These permits are generally valid for a period of three years but can be extended. Generally, the applicants that are successful are those that fulfill Germany’s larger economic interest.

A residence permit for the purposes of employment must also be applied for within Germany itself and the criteria that applications are based on include i) labor market conditions in Germany for the said occupation ii) adequacy of wage offered and iii) work conditions.

- Greece – Businessmen and Investors who seek to be self-employed in Greece must apply for a residence permit for the purpose of independent economic or investment activities. In order to qualify, the applicant must have i) a visa to stay in Greece while the application is processed ii) financial resources of €60,000 in a bank account or €300,000 in capital and a iii) business plan. Residence permits for independent economic activities are valid for two years whereas those for the purpose of investment are valid for three years.

- Hungary – Foreigners who wish to be self- employed in Hungary must apply for a residence permit for the purpose of gainful employment and register as a self-employed entrepreneur at the Central office for Administrative and Electronic Public Services. For foreigners seeking employment, they either have to go through a i) single permit which authorizes both employment and residence or ii) get a work permit first and then apply for a residence permit.

- Ireland – In order for a non-EEA citizen to be self-employed in Ireland, he/she must first obtain a business permission from the Irish Naturalization and Immigration Service. These applicants must create employment for others through their business and show personal investment of €300,000 or more. These permissions are generally granted for a period of 1 year, but is renewable. After obtaining the permission, applicants must apply for a D-visa. Ireland also has an Immigrant Investor Programme that enables non-EEA investors and their families to reside in Ireland for up-to 5 years. The minimum investment capital required for this scheme is €500,000.

Employed foreigners on the other hand must apply for an employment permit. In most cases, the applicant’s annual salary must be at least €30,000 in order to qualify for the permit. After obtaining the employment permit, the applicant must also apply for a D-visa. Employment permits are initially issued for a maximum of two years.

- Italy – After incorporating a company in Italy, non-EU entrepreneurs and employees who wish to move to Italy must obtain i) an authorization for self-employed/employed work and ii) a residence permit within eight days of entering Italy. Because Italy imposes an annual quota on foreign residents, the applicant must first be verified as falling within the quota by the Single Desk for Immigration and the Provincial Directorate of Labor. These authorities also evaluate whether the business/employer has the correct licenses, whether you have enough financial resources, applicant’s qualifications etc. The authorization is granted for a maximum of two years. Following this authorization, the applicant must apply for a residence permit.

- Latvia – Foreign entrepreneurs must obtain a residence permit for a self-employed person if they wish to reside in Latvia to run their Latvian company. Documents required to obtain this permit include i) a business plan signed by an auditor ii) proof of sufficient financial funds to start the business and iii) business activity specific licenses (if applicable). These permits are granted for one year.

Foreign employees must obtain a work permit and a temporary residence permit. The residence permit is issued for up to five years.

- Lithuania – Self-employed and employed foreigners in Lithuania must apply for a temporary residence permit and in some cases, an additional work permit. Residence permits for self- employed applicants are granted for one year whereas those for employed applicants are granted for two years.

- Luxembourg – Foreigners must apply for a resident permit either for the purposes of self-employment or employed work. These permits are generally granted for one to three years.

- Malta – In Malta, both self-employed foreigners and employed foreigners must apply for an Employment and Training Corporation (ETC) Employment license and a residence permit. While the applications for employed workers is judged based on labor market conditions, the applicant’s qualifications and employer’s recruitment history, self-employed candidates must meet one of the following criteria:

- Within six months of receiving the ETC license, you must invest in Malta capital expenditure of at least €100,000. This capital expenditure should only be used to buy fixed assets for business purposes. One must obtain a reference letter from a reputable Maltese bank certifying that you are capable of raising this capital;

- You must be a highly skilled innovator with i) a strong business plan and ii) commitment to recruit at least three EEA nations within eighteen months of registering your company;

- You must be the sole representative for a branch office of a foreign company. The parent company must be at least three years old and have good reputation;

- You are leading a Malta Enterprise approved project.

- The Netherlands – Foreigners who wish to be self- employed in the Netherlands must apply for a provisional residence permit (mvv) and/or a residence permit. The residence permit is generally issued for two years.

Employed foreigners will need to apply for an mvv and/or a single permit. The single permit combines the residence permit and the work permit. The single permit will be granted for a maximum period of three years.

- Poland – Entrepreneurs from outside the EU must obtain a residence permit to work and stay in Poland whereas employed foreigners must have a temporary residence permit and a work permit. Residence permits are generally valid for two years whereas work permits can be granted for up to three years.

- Portugal – Self-employed foreigners must apply for a temporary residence permit. There are minimum investment requirements to obtain this permit. The criteria include i) capital transfer of at least €1 million ii) creation of at least 10 jobs iii) purchase of real estate property above €500,000. These permits are generally valid for 1 year. Employed foreigners are required to have a residence permit. Applicants of these permits are subject to the Portuguese government’s annual quota on foreigners.

- Romania – Our Clients who wish to be self-employed in Romania must apply for a Long-Stay visa and a temporary residence permit. Those looking to get temporary residence permit for commercial activities must i) legally own the headquarters of the company ii) have management or administrative capacity as a shareholder or associate and iii) have means of at least €700/month as a shareholder or €500/month as an associate. This permit is usually valid for one year and is renewable.

Employed workers must first obtain work authorization, then apply for a Long-Stay visa and a temporary residence permit.

- Slovakia – Non-EU self- employed foreigners in Slovakia must obtain a temporary residence permit for the purposes of conducting business. This permit is usually issued for a maximum of three years. Employed workers can apply for a single permit to reside and work. This permit is usually issued for two years. At least 30 days prior to applying for this permit, the employer must report a vacancy for the applicant’s position at the relevant Labor office.

- Slovenia – Foreigners in Slovenia must have been residing in the country for at least a year before they can apply for a self-employment permit. The applicant must also extend their existing residence permit after they receive the self- employment permit.

Employed foreigners have to obtain an employment permit and then a residence permit. These permits are generally issued for a period of one year and are renewable. Foreign workers will be subject to the annual quota that the government of Slovenia imposes each year.

- Spain – Entrepreneurs who are not EU citizens must apply for a work and residence permit before entering Spain. After obtaining these permits, they must then apply for a work and residence visa at the Spanish consulate in their country of origin. Work permits are generally issued for one year and applications are primarily judged on the business plan and sufficiency of financial resources. Large investors have the alternative of a golden visa if their direct investment in Spain reaches i) a minimum of €0.5 million in real estate; ii) €1 million in equity or iii) €2 million in issued government bonds.

Work permits for employed workers are granted only if the job falls under the “Shortage Occupations List”. However, if the job is not on this list, the applicant may still be able to obtain a work permit if the employer can prove that they cannot find a suitable local employee.

- Sweden – Our non-EU Clients who wish to move to Sweden to run their company must apply for a residence permit. Applications are judged by the Migration Board, which evaluates them based on the business plan. The applicant must also prove that they own at least 50% of the company and is involved in the day-to-day running of the business.

The alternative for non-EU nationals looking to migrate to Sweden is to obtain a work and residence permit as an employed worker. Before applying for a work permit, the employer must have advertised the job opening in Sweden and the EU for at least ten days. These permits are generally issued for a period of two years.

- UK – Foreign entrepreneurs and investors can apply for a Tier 1 Entrepreneur visa in the UK. There are various requirements one must meet in order to be eligible for this visa including i) access to £50,000 in investment funds ii) proficiency in English and iii) a score of at least 95 under the UK’s immigration points scheme. Tier 1 visas are granted for up to 3 years.

Foreign employed workers looking to work in the UK must obtain a Tier 2 visa. Applicants must have i) have at least moderately good command of English ii) receive at least £20,800 in annual salaries and iii) a certificate of sponsorship.

- Austria – If our Clients intend to be self-employed in Austria, they can apply for a Red-White-Red card. This permit is applicable only if the applicant’s company in Austria is deemed creating macroeconomic benefit by i) providing regular investment capital to Austria ii) creates new jobs in Austria iii) introduces new technology in Austria and iv)the company is of considerable significance for the entire region.

Migration to the European Union with no investment requirements

By providing clear immigration strategies since 2003, Healy Consultants assists our Clients to migrate to the European Union with cost-efficient Latvian business registration. We managed to source the optimal way to obtain residence permit in EU, allowing free travel and family relocation. View our relevant up to date information below:

- With our Latvian company setup solution, you can begin trade and operations in less than two weeks from due diligence collection;

- Our Latvian relocation strategy does not require capital investment unlike other European Union relocation solutions;

- Within a month from the Latvian business registration allows our Clients to obtain Schengen Visa for free travel around the European Union;

- Within one year of operations, Healy Consultants can apply for a European Union residence permit for our Client, allowing him to live anywhere within the borders of the Union;

- The country boasts excellent business reputation, because i) it is part of the Eurozone; ii) has a broad network of 55 double taxation treaties and iii) offers high quality of life;

| Migration to the EU package | |

|---|---|

| Average engagement costs | €11,890 |

| Draft invoice | View invoice PDF |

Steps to start a company and obtain a visa for the EU

Healy Consultants will be pleased to assist our Clients to i) form their company in the EU ii) open a corporate bank account for the company and iii) obtain a residency permit on their behalf and/or for their foreign employees. During the engagement, we will also prepare all supporting documents for the visa application, including a comprehensive business plan detailing our Client’s proposed business activities in the EU and a convincing outline of reasons for migration to the EU.

Such EU engagement is typically completed in a series of steps summarized below. Our Client is not required to travel in order to complete them.

- Our Clients i) sign our Client engagement letter ii) settles the fees applicable to the engagement and iii) provides us with all the due diligence documents requested for the project;

- Our Clients and Healy Consultants agrees upon the corporate structure of the company and the type of entrepreneur visa we will apply for. Our Firm then immediately registers the company’s name and provides our Client with a i) comprehensive business plan and ii) a detailed project plan. Mapping out week by week each step towards completion of the project, this document is prepared in order to be fully transparent on how our team will project manage our Client’s engagement;

- Our Firm then provides our Client with i) an address for the company for registration in their preferred country in the EU and ii) if required, nominee services for resident director, who will be appointed until our Clients obtain their visas. If needed, we can also provide our Clients with virtual office services;

- Healy Consultants then i) registers the company with the relevant Company registration authority and ii) registers the company for tax. If requested by our Client, we also register the company for EU VAT;

- Healy Consultants then opens a corporate bank account with the bank preferred by our Client;

- To optimize the likelihood of visa approval, our Client injects the minimum amount of capital required for the type of visa he expects to apply. This amount is different for each country;

- Healy Consultants assists our Client to prepare a complete, high quality, entrepreneur visa application and then submits it on his behalf to the relevant immigration authority. If needed, we also apply for dependent passes on behalf of our Client’s immediate family (spouse and children);

- During the Government review of the visa application, Healy Consultants will be pleased to assist our Client with relocating to the EU;

- Our Clients obtains his entrepreneur visa and relocates to the EU. If required, Healy Consultants changes the corporate structure of the company to remove the nominee providing temporary resident director services to our Client. If required, Healy Consultants also assists our Clients to apply for work permits for their non-EU employees. The engagement is completed;

- Healy Consultants couriers to our Client a full company kit, unopened bank correspondence and a client feedback survey to assess the quality of services provided by our Firm during the engagement.

Advantages of migration to the EU

Our Clients are interested in migrating to the EU for the following reasons:

- The European continent has the second highest life expectancy of 78 years;

- The European Economic Area (EEA) allows free movement of goods, services, persons and capital within its member states. Hence traveling and doing business within the EU is easy;

- EU countries in general are politically stable with low crime and corruption rates;

- Strong labour laws protect local and international workers, operating from the EU;

- Migrating to EU will result in better education as it hosts 42% of the top universities in the World;

- 5 out of the top 10 cities with the highest quality of living for expatriates is in the EU, according to Mercer’s Quality of Living Survey 2015;

- 3 out of 10 easiest places to do business in the World are in the EU, according to the World Bank;

- 5 out of 10 most competitive countries are in EU, according to the World Economic Forum’s Global Competitiveness Index.