Korean cryptocurrency opportunities in 2025

Since 2016, Healy Consultants Group assists multi-national Clients with Korean cryptocurrency business set up including i) company registration and multi-currency corporate bank account opening, ii) regulated exchange trading account approvals, iii) regulatory licence exemption, iv) professional passive nominee resident director services, v) professional passive nominee resident bank signatory services and vi) daily communication with Korean banks and exchanges.

In December 2020, 21% of the world’s Bitcoin buying and selling was carried out in the Korean currency. In other words, a country that represents only 0.6% of the planet’s population accounts for over 20% of all cryptocurrency trading in the world. So, how does a country of only 50 million people become the third-largest Bitcoin market, behind Japan and the USA?

-

Why is trading bitcoin in Korea profitable?

- Korean crypto exchanges are quoting Bitcoin (BTC) prices that are about 10% higher than those in the United States and other markets. Our multi-national Clients purchase cryptos in US$ and sell them on Korean exchanges. This capital gain is known as the Kimchi Premium. The Kimchi Premium was approximately 21% in April 2021.

- In 2021, annual cryptocurrency trading net profits of the Korean LLC are legally tax exempt.

- The KRW maintains a close relationship with the US$. Consequently, foreign exchange risk is limited.

For multi-national Clients, the Korean cryptocurrency market is liquid and profitable because:

- Cryptocurrency trading is popular in South Korea because the country is technologically advanced with 5G high-speed internet; so trading cryptocurrencies is simple and quick. Through their cell phone or ATM or credit card, citizens can buy cryptocurrencies in Korean Bitcoin stores including 7-11 or Mini Stop.

- The virtual currency market is open 24/7 with huge changes in the price happening suddenly and seemingly without warning. Young Koreans engage in day-trading, hoping to hit the jackpot. Cryptocurrency profits and gains are tax free. In the first half of 2021, volumes on top Korean cryptocurrency exchanges surpassed equity volumes on the country’s stock market.

- Korean citizens have an insatiable demand for cryptocurrency trading because it is perceived as a lottery ticket to get rich fast, especially with high youth unemployment of 10%. Consequently, one in three citizens either own cryptocurrencies or get paid in them. According to a Korean study cited in Quartz, in 2017, over a third of South Korea’s workers were investing in cryptocurrencies like Bitcoin and Ethereum.

-

The Korean cryptocurrency business set up strategy

To take advantage of the Kimchi Premium, Healy Consultants Group recommends our multi-national Clients to:

- Register a wholly foreign-owned Korean LLC. Some of our Clients register a Singapore legally tax exempt company to hold the shares of the Korean LLC.

- With our preferred Korean bank, open a multi-currency corporate bank account with US$ and won. See this page regarding our ‘guaranteed corporate bank account opening or your money back’ policy. If required, Healy Consultants Group can offer our multi-national Clients a professional passive nominee resident bank signatory.

- Inject at least US$100,000 paid-up share capital into the Korean multi-currency corporate bank account. These funds can be later used to purchase Korean cryptocurrency.

- Because Korean crypto exchanges currently do not allow corporate holders of cryptocurrency wallets to convert their crypto into fiat, Healy Consultants Group supplies our multi-national Clients with a professional passive resident nominee director.

- Secure multiple Korean cryptocurrency wallets with the top four local exchanges including i) Bithumb, ii) Coinone, iii) Upbit and iv) Korbit. Ensure the Korean exchange is registered as a Virtual Asset Service Provider (VASP).

- Liquidate Korean cryptocurrency gains into the won corporate bank account. The average daily liquidation limit is US$100,000 and the exchange withdrawal fees range from 0.0005 to 0.0015 BTC. To withdraw Bitcoins directly – $20 to $60 for one BTC at $40,000.

- Over the following months, repatriate the Korean earnings to overseas bank accounts.

-

Challenges with Korean crypto trading

It is currently challenging for foreigners to trade on Korean cryptocurrency markets and remit the income generated from such trades outside of Korea, because:

- Cryptocurrencies arbitrage weakens the strength of the won. Because of the Kimchi Premiums, the won is the fourth-most traded currency for Bitcoin, behind the Yen, Euro and US$. Consequently, the Korean government i) requires banks to provide the regulators with information on accounts they hold for cryptocurrency businesses ii) requires all Korean crypto exchanges to secure a licence and iii) Korean banks to implement strict and thorough due diligence procedures on all domestic and international funds transfers directly or indirectly related to cryptocurrency.

- Consequently, a handful of Korean banks welcome overseas customers engaged in crypto arbitrage. For example, KB Kookmin Bank introduced a cryptocurrency custody service called KBDAC.

- In South Korea, cryptocurrencies are not yet considered legal tender.

Because of the above, multi-national Clients should expect the following:

- Only Korean citizens can open a trading account with a Korean crypto exchange. Korean companies are allowed to open a cryptocurrency e-wallet on the local exchanges but will face restrictions when liquidating their cryptocurrency into fiat.

- When remitting overseas more than US$50,000, Korean banks demand additional information, including details on the nature of the transaction such as i) the origin of the funds, ii) the destination of the transfer and iii) prior transaction history.

- Cryptocurrency taxation in South Korea represents a grey area. Since they are considered neither currency nor financial assets, cryptocurrency transactions are currently tax free. From 1 January 2022, Korean cryptocurrency gains will suffer 20% tax.

- In 2021, all 200 Korean cryptocurrency exchanges must secure a regulatory licence from the Financial Services Commission (FSC), known as a VASP license. It is expected that the vast majority of cryptocurrency exchanges will permanently close. It is expected the four biggest cryptocurrency exchanges will survive. The “big four” exchanges in the country include Bithumb, Coinone, Upbit and Korbit. Only Korean residents are allowed to open accounts on these exchanges.

- The FSS imposed tighter reporting obligations on banks with accounts held by crypto exchanges. The new rules allow cryptocurrency trades only from ‘real-name bank accounts’. In practice, this means that a trader (customer) must open a real-name account at the same bank as their cryptocurrency dealer to make a deposit or extract funds from their e-wallet. Both the bank and dealer must check the trader’s identity in keeping with traditional AML/CFT regulations and with structured transactions reporting requirements.

-

Our fees and timelines

Average engagement fees approximate US$ 29,560 as outlined in the attached pdf file:

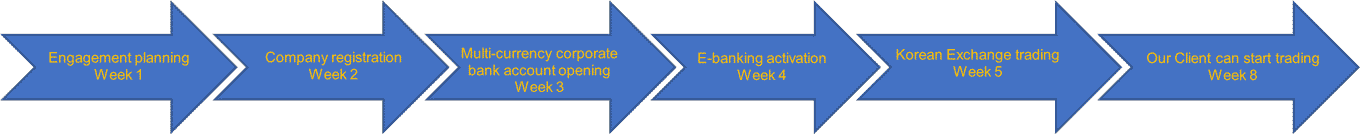

Within 8 weeks, our multi-national Clients can expect to have a Korean LLC and multi-currency corporate bank account and exchange trading account. Refer to diagram below to view how engagement will advance:

-

Other considerations

- There are no capital controls on incoming funds transfers into Korean multi-currency corporate bank accounts.

- Investing in crypto assets in Korea is inherently risky. Only sophisticated investors should engage in this trading activity. Healy Consultants Group does not recommend trading strategies.

- Through our business relationships with Korean banks, Healy Consultants Group will secure welcome emails from bank officers, inviting a formal multi-currency corporate bank account application from our Client. Our team will aggressively negotiate a travel exemption for the Korean LLC shareholders and directors and bank signatory.

- That said, the ultimate power of approval of multi-currency corporate bank account applications rests with the Korean bank in-house Legal and Compliance Department.

- Korean regulations are fluid and unpredictable. Multi-national Clients should expect unexpected obstacles. Healy Consultants Group will supply legal work-around solutions.

- For more information on alternative global crypto-friendly countries, visit this page.

-

Related videos / podcasts

Conclusion

From A to Z, Healy Consultants Group supplies our multi-national Clients with all the professional support they need to establish a crypto-currency trading business in Korea.