Fees and timelines in 2025

Fees

The average fee per Brunei engagement is outlined in the table below. These fees include company incorporation, opening corporate bank accounts, project management and all government fees:

The average fee per Brunei engagement is outlined in the table below. These fees include company incorporation, opening corporate bank accounts, project management and all government fees:

| Different Brunei entity types | Cost | Draft invoice |

|---|---|---|

| Tax resident LLC | US$18,215 | View invoice PDF |

| Branch of a foreign company | US$14,780 | View invoice PDF |

| PLC company | US$26,730 | View invoice PDF |

| Free zone company | US$21,380 | View invoice PDF |

| International trust | US$17,400 | View invoice PDF |

| Brunei Branch Annual Renewal | US$20,565 | View invoice PDF |

Click here to create your own Brunei invoice

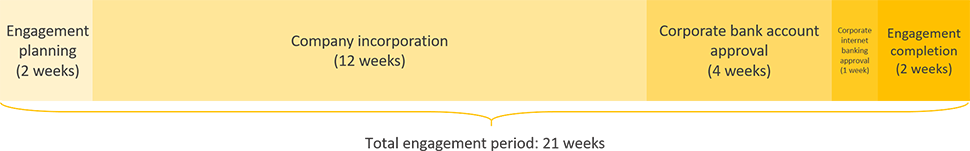

Timelines

The average Brunei onshore company incorporation engagement period is 21 weeks as outlined below:

| Service | Brunei International Partnership | Brunei offshore trust | Brunei LLC | Brunei free zone company | Brunei PLC | Brunei branch |

|---|---|---|---|---|---|---|

| Engagement planning | 1 week | 1 week | 2 weeks | 2 weeks | 2 weeks | 4 weeks |

| Company incorporation period | 2 weeks | 2 weeks | 3 months | 5 months | 3 months | 14 weeks |

| Bank account approval | 1 month | 1 month | 1 month | 1 month | 1 month | 1 month |

| Internet banking approval | 1 week | 1 week | 1 week | 2 weeks | 2 weeks | 2 weeks |

| Incorporation completion | 2 weeks | 2 weeks | 2 weeks | 2 weeks | 1 week | 1 week |

| Total engagement period | 10 weeks | 10 weeks | 21 weeks | 30 weeks | 21 weeks | 25 weeks |