Fees and timelines in 2025

Fees

| Different Denmark entity types | Cost | Draft invoice |

|---|---|---|

| Tax resident LLC | €20,910 | View invoice PDF |

| LLP | €11,655 | View invoice PDF |

| Branch of a foreign company | €12,915 | View invoice PDF |

| Representative office | €11,665 | View invoice PDF |

| Stock corporation | €11,655 | View invoice PDF |

| Bitcoin LLC | €15,655 | View invoice PDF |

Click here to create your own Denmark invoice

Timelines

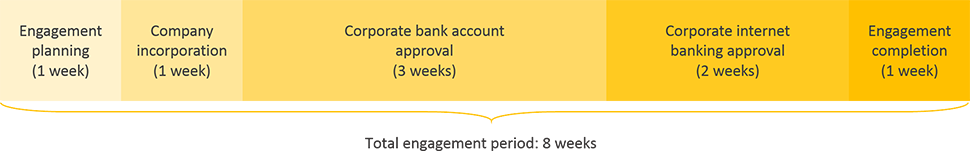

The average engagement period for company registration is 8 weeks as outlined below:

| Service | Duration |

|---|---|

| Engagement planning | 1 week |

| Company incorporation | 1 week |

| Corporate bank account approval | 3 weeks |

| Corporate internet banking approval | 2 weeks |

| Engagement completion | 1 week |

| Total engagement period | 8 weeks |