Singapore company de-registration in 2025

Since 2003, Healy Consultants Group assists our multi-national Clients to de-register their Singaporean entities and close the corporate bank account. Our expert staff efficiently project manage the Singapore company deregistration process from start to finish, without our Clients needing to visit Singapore.

-

Singapore company de-registration

Singapore company deregistration is the optimum strategy for a company which i) has ceased operations ii) is not and will not be involved in any court proceedings iii) has no assets and liabilities iv) has no outstanding penalties or offers of compensation, is not indebted to other government departments or has no outstanding tax liabilities v) has no outstanding charges in its charge register vi) has no officers with outstanding summonses or vii) has closed its corporate bank account.

Applications to deregister a Singapore company are submitted to the Accounting and Corporate Regulatory Authority (ACRA), together with i) dormant financial statements and ii) statutory forms signed by shareholders and directors.

-

Steps to strike off a Singapore company

Healy Consultants Group will efficiently ensure all ACRA criteria for striking off a company are satisfied. These are:

- Our Client accurately and completely discharges their annual legal and compliance, accounting and tax obligations. This includes i) submitting an up-to-date financial statement showing zero assets/liabilities in the balance sheet and ii) applying to the Inland Revenue Authority of Singapore (IRAS) for a corporate tax return submission waiver (if eligible).

- Submitting an online application to ACRA for strike off.

- Upon the application being approved, ACRA may send a striking off notice to the company’s officers (such as director, company secretary and shareholder) at their address in Bizfile records. However, if the officers are based outside of Singapore and postal service is disrupted*, the strike off process may be delayed or may require the application for striking off to be resubmitted on ACRA when postal services have resumed.

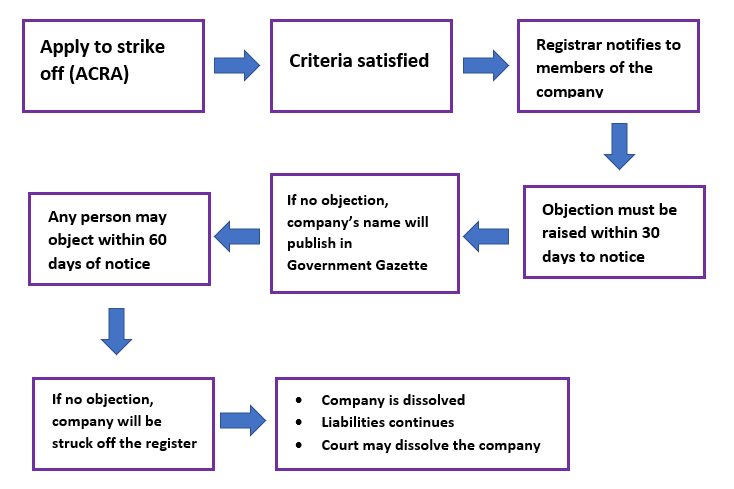

- Thirty days after approving the strike-off application, and if there is no objection from any party, ACRA publishes the company name in the Singapore Government Gazette.

- Sixty days after publishing the company name in the Singapore Government Gazette, and if there is no objection, ACRA again publishes the company name in the Gazette and the company is considered officially struck off.

- Steps to deregister a Singapore company follow:

** During the start of the Covid-19 pandemic, postal services to certain countries ceased for a duration ranging from 2 weeks to a few months.

-

Outstanding Accounting and Tax considerations

Before applying to ACRA for strike off, the Singaporean entity must timely, accurately and completely discharge its outstanding legal, accounting and tax obligations including:

- Ensuring there are no outstanding tax liabilities with IRAS, including i) finalizing and settling all assessments and ii) cancelling GST registration if necessary.

- Submitting income tax returns (Form C-S/C) to cover the period up to the cessation of business.

- Submitting financial statements and tax computations (for companies filing Form C).

- A tax return waiver is available under certain circumstances.

-

Legal and Compliance considerations

To strike off a Singapore company, the following legal and compliance criteria must be met:

- The company has not commenced business since incorporation, or has ceased trading.

- The company has no outstanding debts owed to IRAS, or any other Singapore government agency.

- There are no outstanding charges in the company’s charge register.

- The company is not involved in any legal proceedings (within or outside Singapore).

- The company has no existing assets and liabilities as of the date of application, and has no contingent asset and liabilities.

- The majority of company directors must authorize the strike-off applicant to submit the online application via ACRA.

- The corporate bank account can be closed either prior to, or after, deregistering the company. If the account is closed after the company is struck off, any tax credits can be refunded to the company;

-

Engagement fees

Healy Consultants Group’s one-off fee to complete Singapore company deregistration is US$1,450. Refer to attached pdf file to view a typical sales invoice relating to the de-registration of a Singaporean LLC:

Conclusion

Healy Consultants Group in-house Accounting and Tax Department will assist you to timely accurately and completely de-register your Singaporean entity. To advance the engagement, communicate with our Staff below: